Question: John Smith, a security analyst, has been assigned to analyze China Mobile using the constant-dividend- growth model. John assumes that China Mobile's earnings and dividends

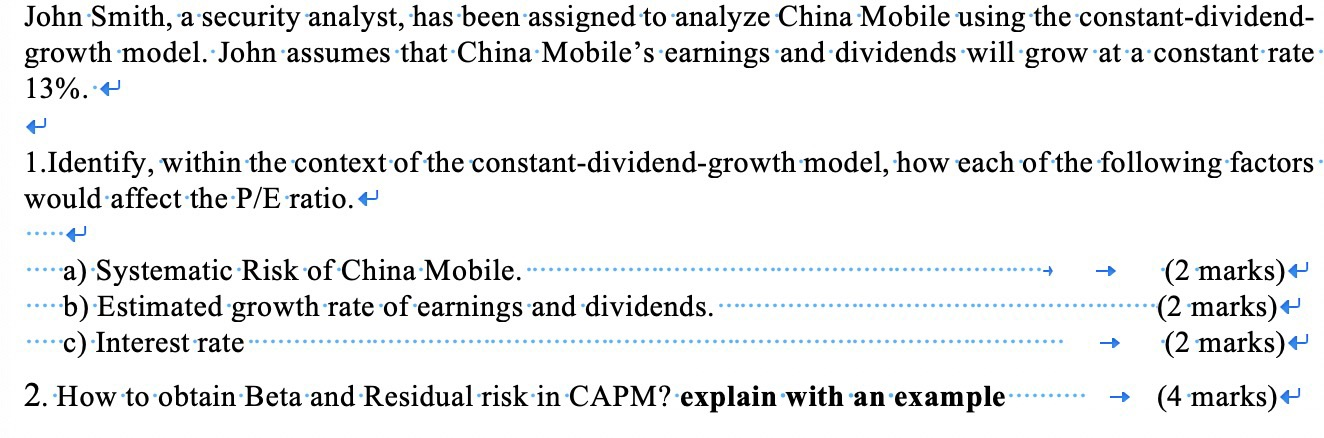

John Smith, a security analyst, has been assigned to analyze China Mobile using the constant-dividend- growth model. John assumes that China Mobile's earnings and dividends will grow at a constant rate 13%. + 1.Identify, within the context of the constant-dividend-growth model, how each of the following factors would affect the P/E ratio. a) Systematic Risk of China Mobile. b) Estimated growth rate of earnings and dividends. c) Interest rate (2 marks) (2 marks) (2 marks) (4 marks) 2. How to obtain Beta and Residual risk in CAPM? explain with an example John Smith, a security analyst, has been assigned to analyze China Mobile using the constant-dividend- growth model. John assumes that China Mobile's earnings and dividends will grow at a constant rate 13%. + 1.Identify, within the context of the constant-dividend-growth model, how each of the following factors would affect the P/E ratio. a) Systematic Risk of China Mobile. b) Estimated growth rate of earnings and dividends. c) Interest rate (2 marks) (2 marks) (2 marks) (4 marks) 2. How to obtain Beta and Residual risk in CAPM? explain with an example

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts