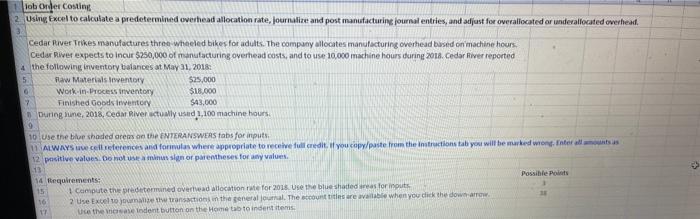

Question: 7 loborder Costing 2. Using Excel to calculate a predetermined overhead allocation rate, journalize and post manufacturing journal entries, and adjust for overallocated or undevallocated

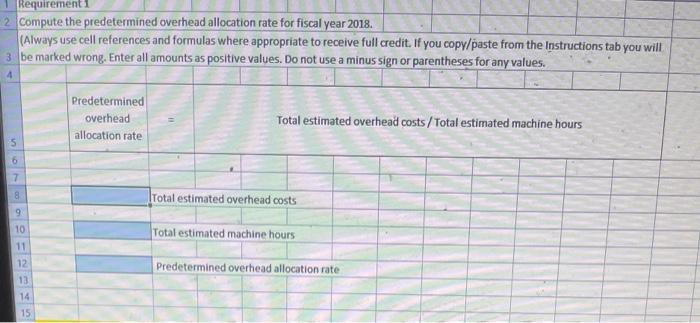

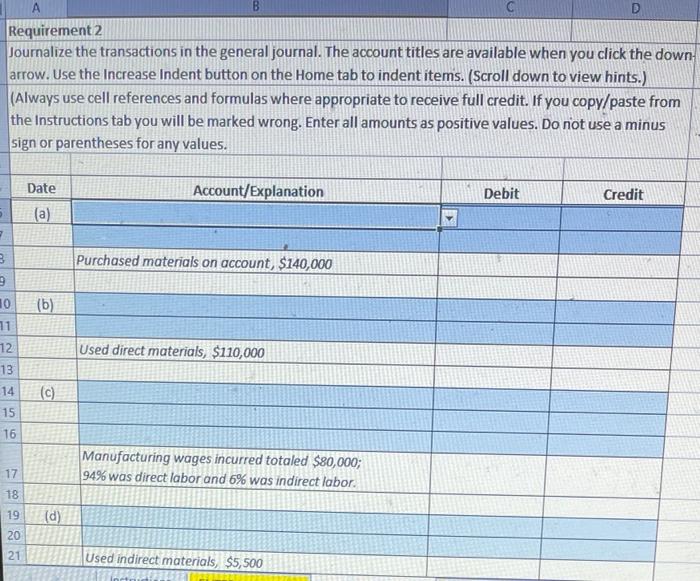

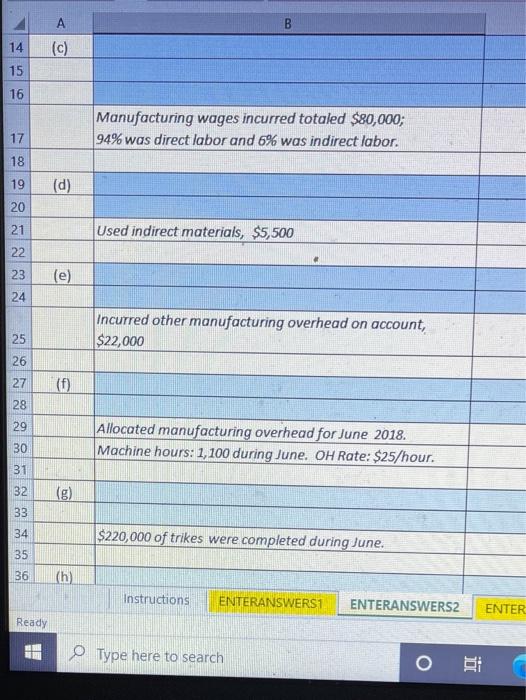

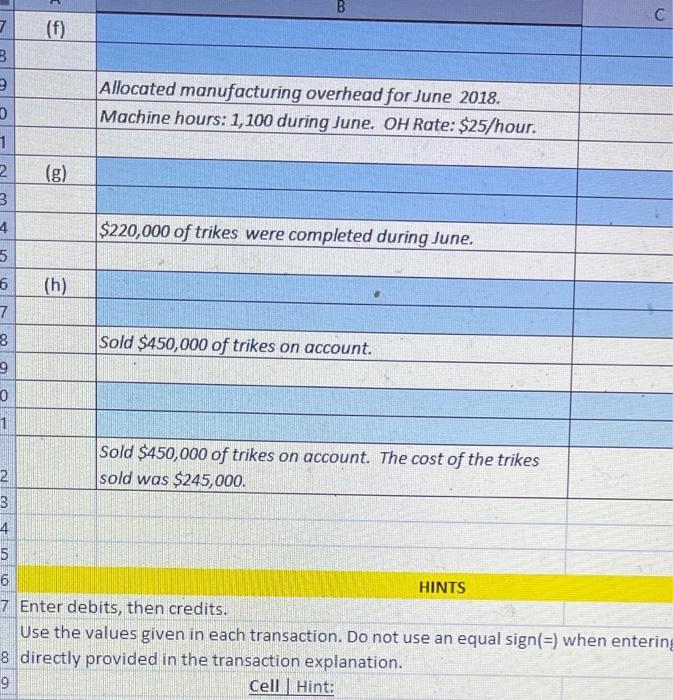

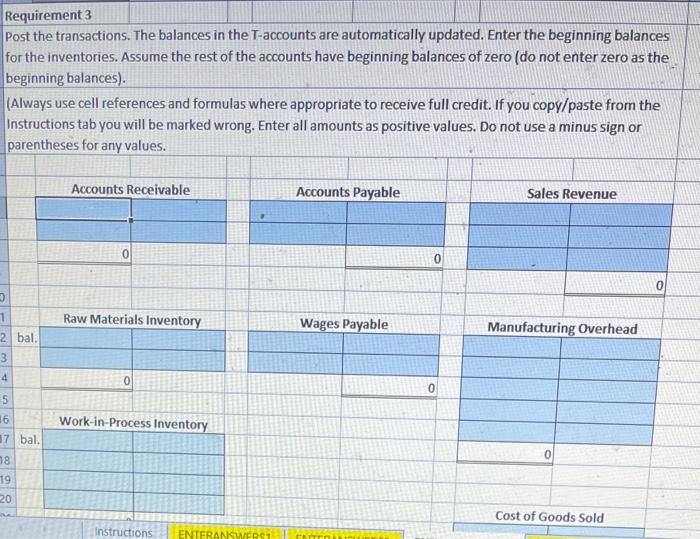

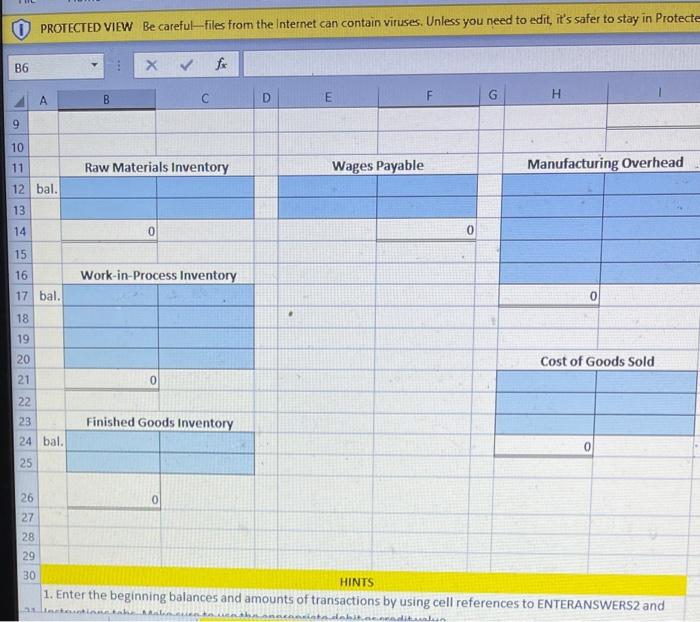

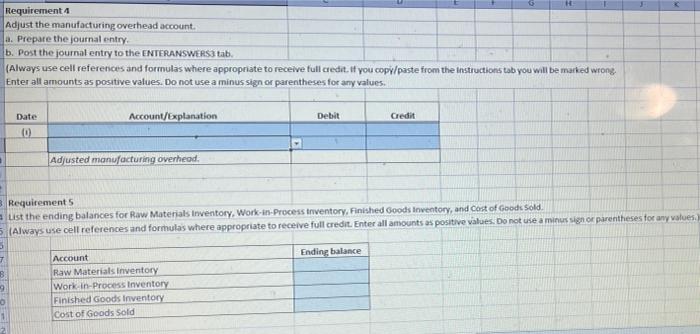

7 loborder Costing 2. Using Excel to calculate a predetermined overhead allocation rate, journalize and post manufacturing journal entries, and adjust for overallocated or undevallocated overhead. 3 Cedar River Trikes manufactures three wheeled bikes for adults. The company allocates manufacturing overhead based on machine hours Cedar River expects to incur $250,000 of manufacturing overhead costs, and to use 10.000 machine hours during 2018. Cedar River reported the following inventory balances at May 31, 2018 5 flaw Materials twentory $25,000 Work in Process inventory $18.000 Finished Goods twentory $4,000 During June, 2018, Cedar River actually used 1.100 machine hours 9 10 Use the blue shaded areas on the INTERANSWERS tabs for inputs. 11 ALWAYS we creferences and formulas where appropriate to receive full credit. if you copy/paste from the instructions tab you will be marked wrong. Inte alls 12 punitive values. Do not use musian or parentheses for value 13 14 Requirements: Possible Points 15 1 compute the predetermined overhead allocation rate for 2018. Use the blue shadedreas for inputs 16 2 Use Excel to your transactions in the general journal. The countries are available when you click the downtow. 17 Use the versendent button on the Home tab toindentitems Requirement 2 compute the predetermined overhead allocation rate for fiscal year 2018. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will 3 be marked wrong. Enter all amounts as positive values. Do not use a minus sign or parentheses for any values. 4 Predetermined overhead allocation rate Total estimated overhead costs / Total estimated machine hours 5 6 7 Total estimated overhead costs Total estimated machine hours 8 9 10 11 12 13 14 15 Predetermined overhead allocation rate Requirement 2 Journalize the transactions in the general journal. The account titles are available when you click the down arrow. Use the Increase Indent button on the Home tab to indent items. (Scroll down to view hints.) (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked wrong. Enter all amounts as positive values. Do not use a minus sign or parentheses for any values. Date Account/Explanation Debit Credit (a) 17 Purchased materials on account, $140,000 (6) 3 9 10 11 12 13 14 15 16 Used direct materials, $110,000 (c) Manufacturing wages incurred totaled $80,000; 94% was direct labor and 6% was indirect labor. 17 18 19 (d) 20 21 Used indirect materials, $5,500 B (c) 14 15 16 Manufacturing wages incurred totaled $80,000; 94% was direct labor and 6% was indirect labor. 17 18 (d) 19 20 21 Used indirect materials, $5,500 22 23 (e) 24 incurred other manufacturing overhead on account, $22,000 25 26 27 (f) 28 29 Allocated manufacturing overhead for June 2018. Machine hours: 1,100 during June. OH Rate: $25/hour. 30 31 32 (g) $220,000 of trikes were completed during June. 34 35 36 (h) Instructions ENTERANSWERS1 ENTERANSWERS ENTER Ready O Type here to search o Si B C 7 (f) 8 Allocated manufacturing overhead for June 2018. 0 Machine hours: 1,100 during June. OH Rate: $25/hour. 1 2 (g) 3 4 $220,000 of trikes were completed during June. 5 6 (h) 7 8 Sold $450,000 of trikes on account. 9 0 1 Sold $450,000 of trikes on account. The cost of the trikes 2 sold was $245,000 3 4 5 6 HINTS 7 Enter debits, then credits. Use the values given in each transaction. Do not use an equal sign(=) when entering 8 directly provided in the transaction explanation. 9 Cell Hint: 5 5 Requirement 3 Post the transactions. The balances in the T-accounts are automatically updated. Enter the beginning balances for the inventories. Assume the rest of the accounts have beginning balances of zero (do not enter zero as the beginning balances). (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked wrong. Enter all amounts as positive values. Do not use a minus sign or parentheses for any values. Accounts Receivable Accounts Payable Sales Revenue 0 1 Raw Materials Inventory Wages Payable Manufacturing Overhead 2 bal. 3 4 0 5 16 Work-in-Process Inventory 17 bal. 18 0 19 20 Cost of Goods Sold Instructions ENTERANSWERS O PROTECTED VIEW Be careful-Files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protecte B6 XV fix D B E H F G 9 10 11 Raw Materials Inventory Wages Payable Manufacturing Overhead 12 bal. 13 14 0 15 16 Work-in-Process Inventory 17 bal. 0 . 18 19 20 Cost of Goods Sold 21 0 22 23 Finished Goods Inventory 0 24 bal. 25 26 0 27 28 29 30 HINTS 1. Enter the beginning balances and amounts of transactions by using cell references to ENTERANSWERS2 and H Requirement Adjust the manufacturing overhead account. a. Prepare the journal entry b. Post the journal entry to the ENTERANSWERS3 tab. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the instructions tab you will be marked wrong Enter all amounts as positive values. Do not use a minus sign or parentheses for any values. Account/Explanation Debit Date 0 Credit Adjusted manufacturing overhead. 3. Requirements list the ending balances for Raw Materials inventory, Work-in-process inventory, Finished Goods Inventory, and cost of Good Sold (Always use cell references and formulas where appropriate to receive full credit. Enter all amounts as positive values. Do not use a minus signor parentheses for any values 5 7 Account Ending balance B Raw Materials inventory 9 Work in Process Inventory Finished Goods Inventory 1 Cost of Goods Sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts