Question: 7. please answer fast and fully thank you! all info is included Employees worked 1,700 hours and were paid $10.50 per hour. Read the tequitements

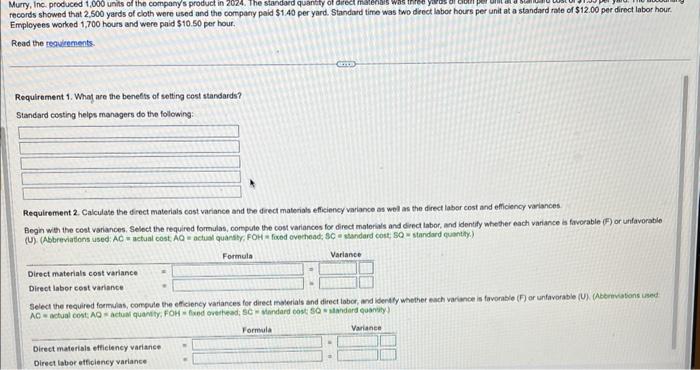

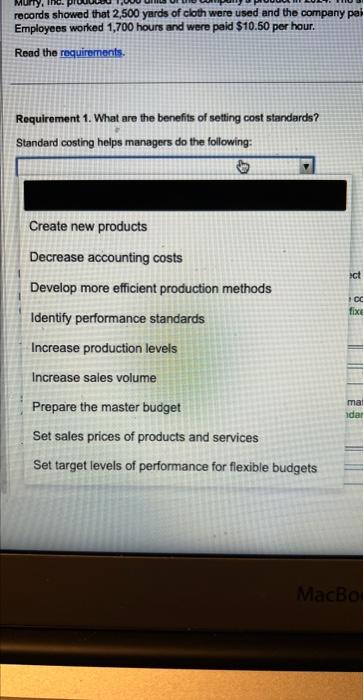

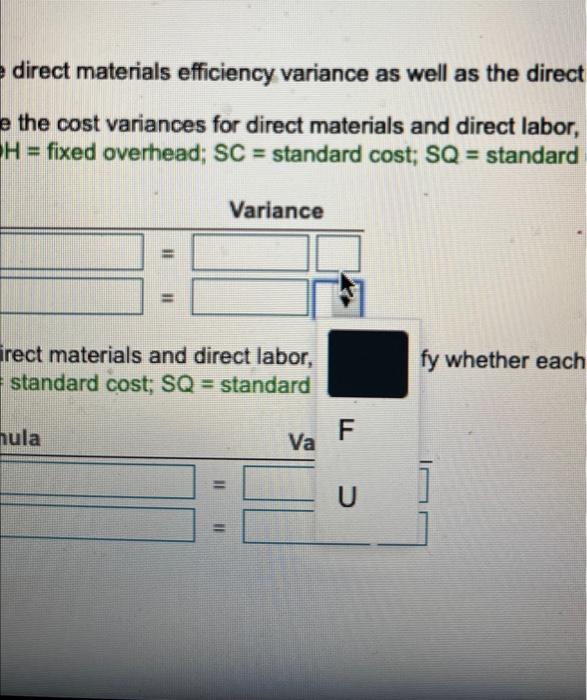

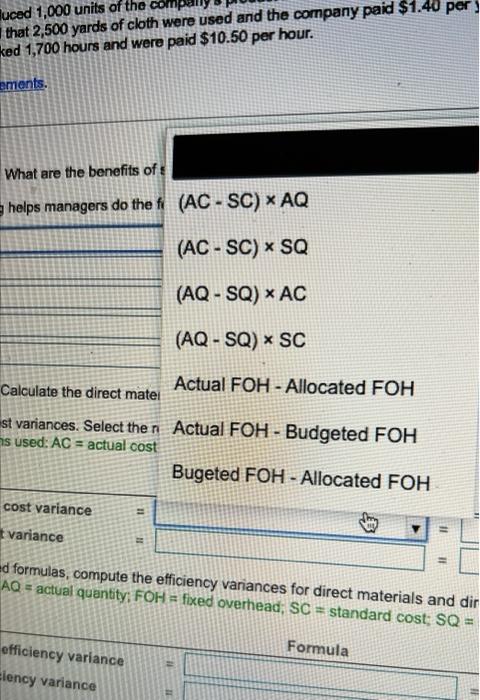

Employees worked 1,700 hours and were paid $10.50 per hour. Read the tequitements Requirement 1. Whaf are the benefits of sotting cost standards? Standard costing helps managers do the following: Requirement 2. Calculate the drect materials cost variance and the direct materials efficiency variance as wol as the direct labor cost and efficiency variances Begin with the cost variances. Select the required formulas, corrpule the cost variancos foc drect malerivis and direct labot, and identify atiotier each variance as favorable (F) or unfavorable (U). (Abbreviations used: AC= actual cost, AQ= actual quarstr, FOH = fored ovechead; SC a sandard cost SQ= standard quanthy.) Select the required formulas, compule the efficiency variances for direct mateials and direct labor, and idenity whether each variance is favonabio (F) or unfavorable (U). (Abernvations used records showed thet 2,500 yards of cloth were used and the company pail Employees worked 1,700 hours and were paid $10.50 per hour. Read the roquirements. Requirement 1. What are the benefits of setting cost standards? Standard costing helps managers do the following: direct materials efficiency variance as well as the direct e the cost variances for direct materials and direct labor, H= fixed overhead; SC= standard cost; SQ= standard that 2,500 yards of cloth were used and the company paid \$1.40 per: ked 1,700 hours and were paid $10.50 per hour. What are the benefits of s helps managers do the f(ACSC)AQ (ACSC)SQ (AQSQ)AC (AQSQ)SC Calculate the direct matel Actual FOH - Allocated FOH st variances. Select the n Actual FOH - Budgeted FOH is used: AC= actual cost Bugeted FOH - Allocated FOH AQ = actual quantity; FOH = fixed variances for direct materials and dir AQ= actual quantity; FOH= fixed overhead; SC= standard cost; SQ= benefits of setting cost standards? Requirements 1. What are the benefits of setting cost standards? 2. Calculate the direct materials cost variance and the direct materials efficiency variance as well as the direct labor cost and efficiency variances. compute the efficiency variances for direct materials and direct labor, and identify whether quantity; FOH= fixed overhead; SC= standard cost; SQ= standard quantity.) Employees worked 1,700 hours and were paid $10.50 per hour. Read the tequitements Requirement 1. Whaf are the benefits of sotting cost standards? Standard costing helps managers do the following: Requirement 2. Calculate the drect materials cost variance and the direct materials efficiency variance as wol as the direct labor cost and efficiency variances Begin with the cost variances. Select the required formulas, corrpule the cost variancos foc drect malerivis and direct labot, and identify atiotier each variance as favorable (F) or unfavorable (U). (Abbreviations used: AC= actual cost, AQ= actual quarstr, FOH = fored ovechead; SC a sandard cost SQ= standard quanthy.) Select the required formulas, compule the efficiency variances for direct mateials and direct labor, and idenity whether each variance is favonabio (F) or unfavorable (U). (Abernvations used records showed thet 2,500 yards of cloth were used and the company pail Employees worked 1,700 hours and were paid $10.50 per hour. Read the roquirements. Requirement 1. What are the benefits of setting cost standards? Standard costing helps managers do the following: direct materials efficiency variance as well as the direct e the cost variances for direct materials and direct labor, H= fixed overhead; SC= standard cost; SQ= standard that 2,500 yards of cloth were used and the company paid \$1.40 per: ked 1,700 hours and were paid $10.50 per hour. What are the benefits of s helps managers do the f(ACSC)AQ (ACSC)SQ (AQSQ)AC (AQSQ)SC Calculate the direct matel Actual FOH - Allocated FOH st variances. Select the n Actual FOH - Budgeted FOH is used: AC= actual cost Bugeted FOH - Allocated FOH AQ = actual quantity; FOH = fixed variances for direct materials and dir AQ= actual quantity; FOH= fixed overhead; SC= standard cost; SQ= benefits of setting cost standards? Requirements 1. What are the benefits of setting cost standards? 2. Calculate the direct materials cost variance and the direct materials efficiency variance as well as the direct labor cost and efficiency variances. compute the efficiency variances for direct materials and direct labor, and identify whether quantity; FOH= fixed overhead; SC= standard cost; SQ= standard quantity.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts