Question: 7.) please fix what is incomplete here. and format like i did please! Return to question 7. The following transactions pertain to the operations of

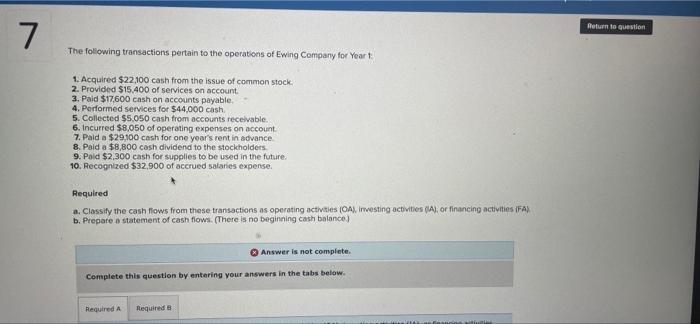

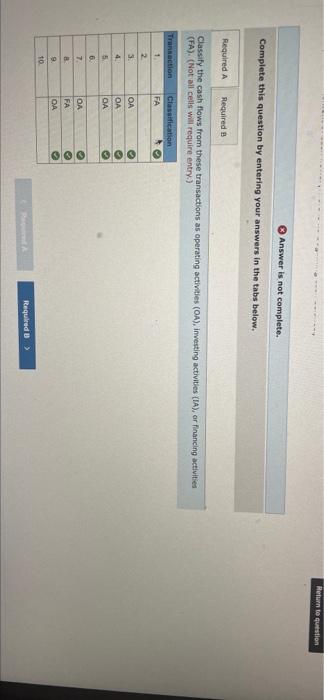

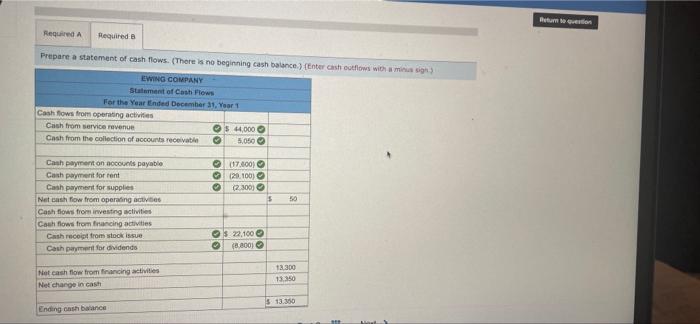

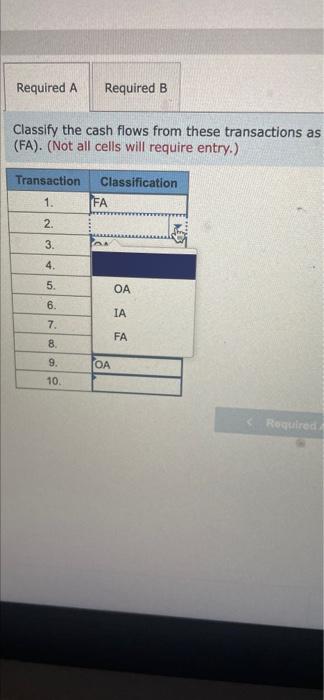

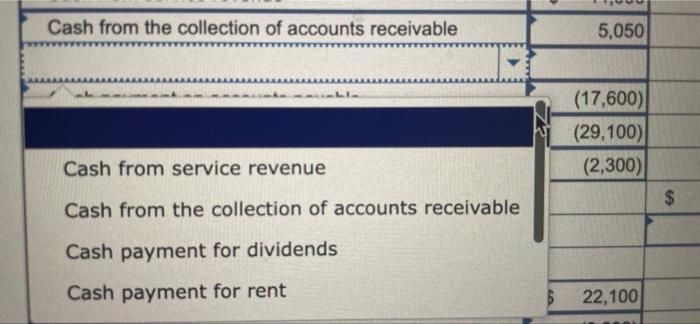

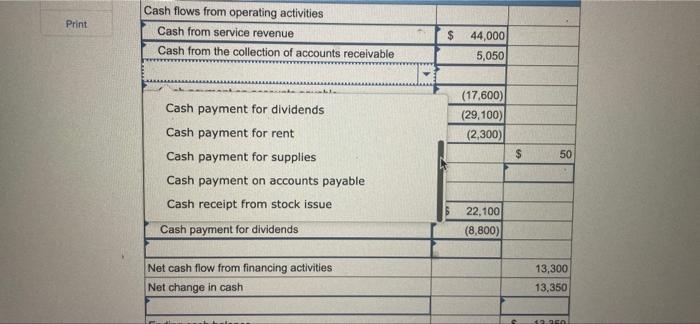

Return to question 7. The following transactions pertain to the operations of Ewing Company for Year 1 1. Acquired $22,100 cash from the issue of common stock. 2. Provided $15.400 of services on account 3. Paid $17.600 cash on accounts payable. 4. Performed services for $44.000 cash 5. Collected $5,050 cash from accounts receivable 6. Incurred $8,050 of operating expenses on account 7. Paid a $29,100 cash for one year's rent in advance 8. Pald a $8,800 cash dividend to the stockholders 9. Pola $2,300 cash for supplies to be used in the future. 10. Recognized $32,900 of accrued salaries expense. Required Classify the cash flows from these transactions as operating activities (OA). Investing activities (A), or financing activities FAX b. Prepare a statement of cash flow (There is no beginning cash balance Answer is not complete Complete this question by entering your answers in the tabs below. Required A Required Required Required Prepare a statement of cash flows. There is no beginning cash balance) Enter cushoto) EWING COMPANY Statement of Cash Flows For the Year Ended December 11. Yar1 Cash flows from operating activities Cash from service revenue 544,000 Cash from the collection of accounts receivable 5,050 OO 17.600) (20.100) (23001 5 Cash payment on accounts payable Cash payment for rent Cash payment for supplies Net cash flow from operating at Cashflows from investing activities Cash flow from financing activities Cash receipt from stock issue Cash payment for dividende $ 22,100 8.2001 Net cash flow from financing activities Net change in cash 12.300 13350 $ 13.30 Ending cash balance Required A Required B Classify the cash flows from these transactions as (FA). (Not all cells will require entry.) Transaction Classification FA 1. 2. 3. 4. 5. 6. IA 7 FA 8 9. 10. Required Cash from the collection of accounts receivable 5,050 LI (17,600) (29,100) (2,300) Cash from service revenue $ Cash from the collection of accounts receivable Cash payment for dividends Cash payment for rent 22,100 Print Cash flows from operating activities Cash from service revenue Cash from the collection of accounts receivable $ 44,000 5,050 (17.600) (29,100) (2,300) $ 50 Cash payment for dividends Cash payment for rent Cash payment for supplies Cash payment on accounts payable Cash receipt from stock issue Cash payment for dividends 22.100 (8,800) Net cash flow from financing activities Net change in cash 13,300 13,350

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts