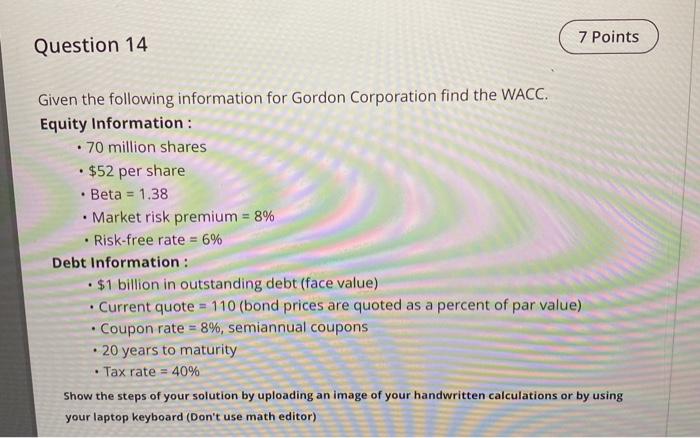

Question: 7 Points Question 14 Given the following information for Gordon Corporation find the WACC. Equity Information: . 70 million shares $52 per share Beta =

7 Points Question 14 Given the following information for Gordon Corporation find the WACC. Equity Information: . 70 million shares $52 per share Beta = 1.38 Market risk premium = 8% . Risk-free rate = 6% Debt Information: $1 billion in outstanding debt (face value) Current quote = 110 (bond prices are quoted as a percent of par value) Coupon rate = 8%, semiannual coupons 20 years to maturity Tax rate = 40% Show the steps of your solution by uploading an image of your handwritten calculations or by using your laptop keyboard (Don't use math editor)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock