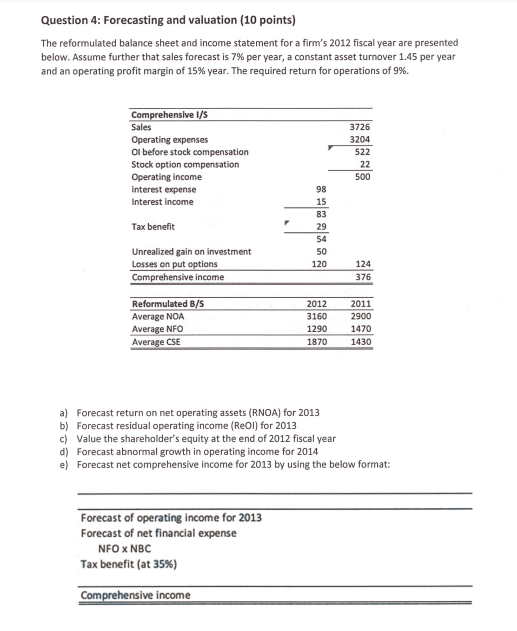

Question: Question 4 : Forecasting and valuation ( 1 0 points ) The reformulated balance sheet and income statement for a firm's 2 0 1 2

Question : Forecasting and valuation points

The reformulated balance sheet and income statement for a firm's fiscal year are presented

below. Assume further that sales forecast is per year, a constant asset turnover per year

and an operating profit margin of year. The required return for operations of

a Forecast return on net operating assets RNOA for

b Forecast residual operating income ReOI for

c Value the shareholder's equity at the end of fiscal year

d Forecast abnormal growth in operating income for

e Forecast net comprehensive income for by using the below format:

Forecast of operating income for

Forecast of net financial expense

NFO NBC

Tax benefit at

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock