Question: 7. Prepare a Statement of Cash Flows, Indirect Method. Madison, Inc.'s most recent balance sheet, income statement, and other important information for 2017 are presented

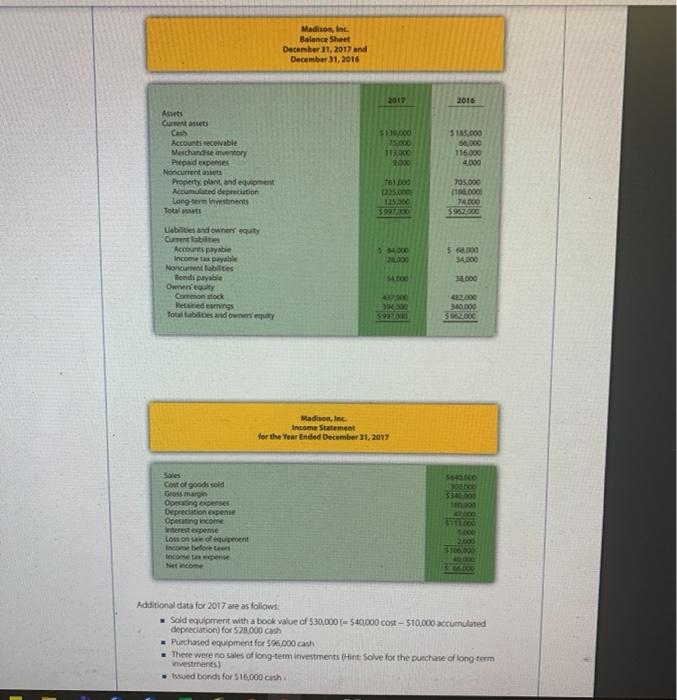

7. Prepare a Statement of Cash Flows, Indirect Method. Madison, Inc.'s most recent balance sheet, income statement, and other important information for 2017 are presented as follows. Madison, Inc Balance Sheet December 31, 2017 and December 31, 2016 2017 2016 Assets Current assets Cash Accounts receivable Merchandise inventory Prepaid expenses Noncurrents Property, plant and equipment Accumulated depreciation Long term intents Totalt 5000 113000 9.000 STOO 16.000 116000 4.000 161.000 1275.000 125.000 705.000 1.000 74.000 Label and owners equity Cament labilities Accounts payabi Income tax payable Noncurrentes Bondi payable 200 5 68.000 34.000 54 od 30.000 Metained earnings Totaltabilities and ownersequity 2000 340.000 3.000 39370 Madison, lec Income Statement for the Year Ended December 31, 2017 500 Sales Cost of goods sold Gross margin Og expenses Depreciation expense Operating income Interest expense Lowon of equipment Bacon before 2.000 310000 Additional data for 2017 are as follows: Sold equipment with a book value of $30,000 $40.000 COSE - 510.000 accumulated depreciation for $28.000 cash Purchased equipment for $96.000 cash There were no sales of long-term investments (Hint: Solve for the purchase of long term investments) issued bonds for 516,000 cash Repurchased common stock (treasury shares) for $45,000 cash Declared and paid $12,000 in cash dividends Required: a. Use the four steps described in the chapter to prepare a statement of cash flows for the year ended December 31, 2017, using the Indirect method. Refer to the format presented in Figure 128 b. Briefly describe the major changes in cash identified in the statement of cash flows. 7. Prepare a Statement of Cash Flows, Indirect Method. Madison, Inc.'s most recent balance sheet, income statement, and other important information for 2017 are presented as follows. Madison, Inc Balance Sheet December 31, 2017 and December 31, 2016 2017 2016 Assets Current assets Cash Accounts receivable Merchandise inventory Prepaid expenses Noncurrents Property, plant and equipment Accumulated depreciation Long term intents Totalt 5000 113000 9.000 STOO 16.000 116000 4.000 161.000 1275.000 125.000 705.000 1.000 74.000 Label and owners equity Cament labilities Accounts payabi Income tax payable Noncurrentes Bondi payable 200 5 68.000 34.000 54 od 30.000 Metained earnings Totaltabilities and ownersequity 2000 340.000 3.000 39370 Madison, lec Income Statement for the Year Ended December 31, 2017 500 Sales Cost of goods sold Gross margin Og expenses Depreciation expense Operating income Interest expense Lowon of equipment Bacon before 2.000 310000 Additional data for 2017 are as follows: Sold equipment with a book value of $30,000 $40.000 COSE - 510.000 accumulated depreciation for $28.000 cash Purchased equipment for $96.000 cash There were no sales of long-term investments (Hint: Solve for the purchase of long term investments) issued bonds for 516,000 cash Repurchased common stock (treasury shares) for $45,000 cash Declared and paid $12,000 in cash dividends Required: a. Use the four steps described in the chapter to prepare a statement of cash flows for the year ended December 31, 2017, using the Indirect method. Refer to the format presented in Figure 128 b. Briefly describe the major changes in cash identified in the statement of cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts