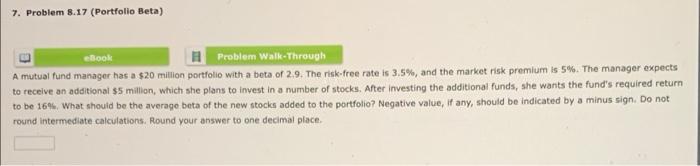

Question: 7. Problem 8.17 (Portfolio Beta) ebook Problem Walk-Through A mutual fund manager has a $20 million portfolio with a bota of 2.9. The risk free

7. Problem 8.17 (Portfolio Beta) ebook Problem Walk-Through A mutual fund manager has a $20 million portfolio with a bota of 2.9. The risk free rate is 3.5%, and the market risk premium is 5%. The manager expects to receive an additional $5 million, which she plans to invest in a number of stocks. After investing the additional funds, she wants the fund's required return to be 1646. What should be the average beta of the new stocks added to the portfolio? Negative value, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to one decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts