Question: 7. Prove Proposition 2.9. (Under an equivalent martingale measures, all (discounted) portfolio value process satisfies the martingale property.) 8 Cive an ayamnle of a cingla

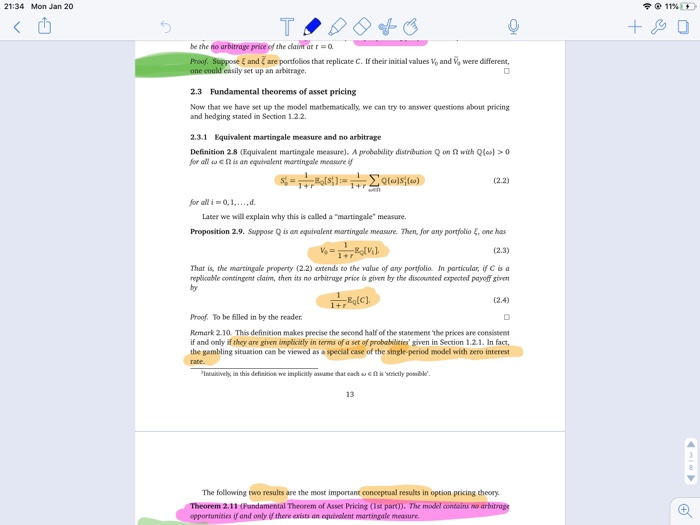

7. Prove Proposition 2.9. (Under an equivalent martingale measures, all (discounted) portfolio value process satisfies the martingale property.) 8 Cive an ayamnle of a cingla nerind model with secare including the hand on that the renli. 21:34 Mon Jan 20 TL 11% + BO be the oarberage price of the diantart=0 Prof. Suppose and are portfolios that replicate. If their initial values one could s et up an arbitrage. and were different 2.3 Pundamental theorems of asset pricing Now that we have set up the model mathematically, we can try to and hedgingated in Section 1.22 wwer questions about pricing 2.3.1 Equivalent martingale measure and no arbitrage Definition 2.8 (Equivalent martingale measure). A probability distribution for all is an equivalent martingale mesure on with local > SHS) + (0)5(c) for all 0,1...... Later we will explain why this is called a "martingale" measure. Proposition 2.9. Suppose is an equivalent martingale measure. Then, for any portfolio V LEV one has (23) That is the martingale property (2.2) extends to the value of any portfolio in particular, Cisa replicable contingent claim, then its no arbitre price is given by the discounted expected payoff given 1-E,[C]. (2.4) Proof To be filled in by the reader Remark 2.10. This definition makes precise the second half of the statement the prices are consistent if and only if they are given implicitly in terms of a set of probabili given in Section 1 21. In fact, the gambling situation can be viewed as a special case of the single period model with zero interest vel in this dat we in h e lp The following two results are the most important conceptual results in option pricing theory Theo 2:11 Pundamental Threem of Asset Pricing (start). The model.co m opportunities and only if there is no t merelem 7. Prove Proposition 2.9. (Under an equivalent martingale measures, all (discounted) portfolio value process satisfies the martingale property.) 8 Cive an ayamnle of a cingla nerind model with secare including the hand on that the renli. 21:34 Mon Jan 20 TL 11% + BO be the oarberage price of the diantart=0 Prof. Suppose and are portfolios that replicate. If their initial values one could s et up an arbitrage. and were different 2.3 Pundamental theorems of asset pricing Now that we have set up the model mathematically, we can try to and hedgingated in Section 1.22 wwer questions about pricing 2.3.1 Equivalent martingale measure and no arbitrage Definition 2.8 (Equivalent martingale measure). A probability distribution for all is an equivalent martingale mesure on with local > SHS) + (0)5(c) for all 0,1...... Later we will explain why this is called a "martingale" measure. Proposition 2.9. Suppose is an equivalent martingale measure. Then, for any portfolio V LEV one has (23) That is the martingale property (2.2) extends to the value of any portfolio in particular, Cisa replicable contingent claim, then its no arbitre price is given by the discounted expected payoff given 1-E,[C]. (2.4) Proof To be filled in by the reader Remark 2.10. This definition makes precise the second half of the statement the prices are consistent if and only if they are given implicitly in terms of a set of probabili given in Section 1 21. In fact, the gambling situation can be viewed as a special case of the single period model with zero interest vel in this dat we in h e lp The following two results are the most important conceptual results in option pricing theory Theo 2:11 Pundamental Threem of Asset Pricing (start). The model.co m opportunities and only if there is no t merelem

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts