Question: 7 Question 7 **added 4/9/2018 no code The market price of a stock is So 100 at time to 0. . The stock does not

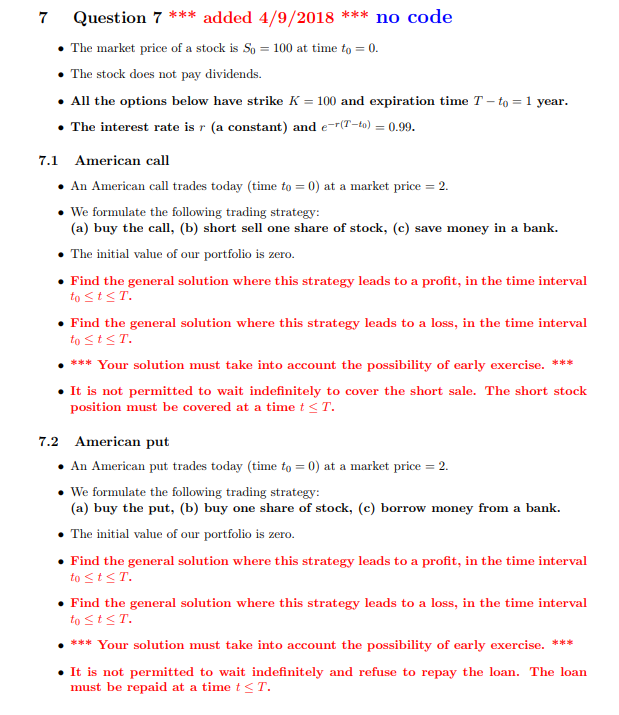

7 Question 7 **added 4/9/2018 no code The market price of a stock is So 100 at time to 0. . The stock does not pay dividends. All the options below have strike K 100 and expiration time T-to-1 year The interest rate is r (a constant) and eTo)0.99 7.1 American call . An American call trades today (time to 0) at a market price 2. . We formulate the following trading strategy (a) buy the call, (b) short sell one share of stock, (c) save money in a bank. The initial value of our portfolio is zero. Find the general solution where this strategy leads to a profit, in the time interval toStsT. Find the general solution where this strategy leads to a loss, in the time interval to StsT Your solution must take into account the possibility of early exercise. It is not permitted to wait indefinitely to cover the short sale. The short stock position must be covered at a time t

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts