Question: stuck on problems formulas in excel solutions 3. Dyl Inc.'s bonds currently sell for $1,040 and have a par value of $1,000. They pay a

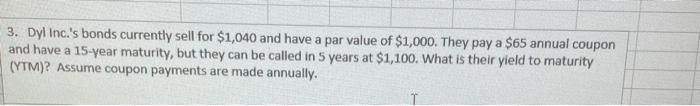

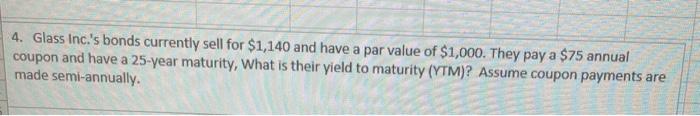

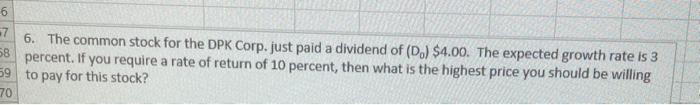

3. Dyl Inc.'s bonds currently sell for $1,040 and have a par value of $1,000. They pay a $65 annual coupon and have a 15-year maturity, but they can be called in 5 years at $1,100. What is their yield to maturity (YTM)? Assume coupon payments are made annually. 4. Glass Inc.'s bonds currently sell for $1,140 and have a par value of $1,000. They pay a $75 annual coupon and have a 25-year maturity, What is their yield to maturity (YTM)? Assume coupon payments are made semi-annually. 6 7 6. The common stock for the DPK Corp. just paid a dividend of (D.) $4.00. The expected growth rate is 3 58 percent. If you require a rate of return of 10 percent, then what is the highest price you should be willing 59 to pay for this stock? 70

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts