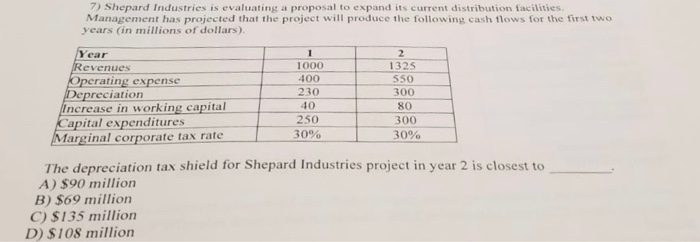

Question: 7) Shepard Industries is evaluating a proposal to expand its current distribution facilities. Management has projected that the project will produce the following cash flows

7) Shepard Industries is evaluating a proposal to expand its current distribution facilities. Management has projected that the project will produce the following cash flows for the first two years (in millions of dollars). Year Revenues Operating expense Depreciation Increase in working capital Capital expenditures Marginal corporate tax rate 1000 1325 400 550 230 300 40 80 250 300 30% 30% The depreciation tax shield for Shepard Industries project in year 2 is closest to A) $90 million B) $69 million C) $135 million D) $108 million

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock