Question: 7. The four mutually exclusive alternatives below are being compared using the Incremental Internal Rate of Return (AIRR) method. What alternative, if any, should be

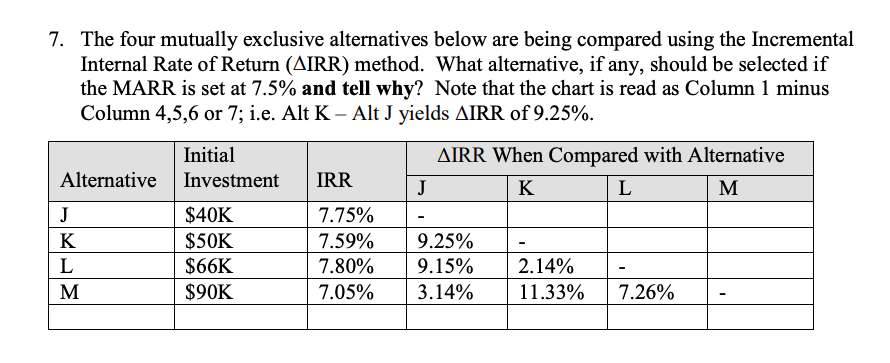

7. The four mutually exclusive alternatives below are being compared using the Incremental Internal Rate of Return (AIRR) method. What alternative, if any, should be selected if the MARR is set at 7.5% and tell why? Note that the chart is read as Column 1 minus Column 4,5,6 or 7; i.e. Alt K - Alt J yields AIRR of 9.25%. Alternative Initial Investment $40K $50K $66K $90K AIRR When compared with Alternative J K L M - 9.25% - 9.15% 2.14% 3.14% 11.33% 7.26% IRR | 7.75% 7.59% 7.80% 7.05% K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts