Question: (7) This problem asks you to value some path-dependent options using one of the meth- ods discussed in the Section 7 notes. Use the 3-period

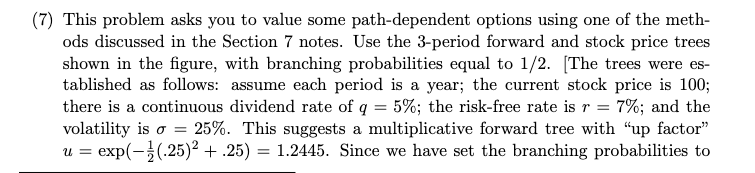

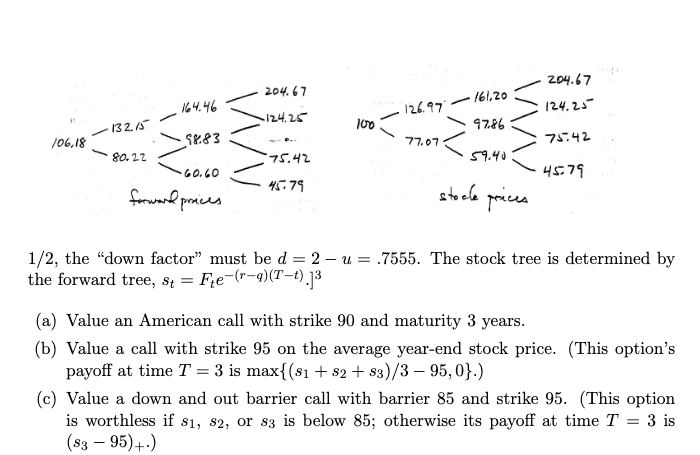

(7) This problem asks you to value some path-dependent options using one of the meth- ods discussed in the Section 7 notes. Use the 3-period forward and stock price trees shown in the figure, with branching probabilities equal to 1/2. [The trees were es- tablished as follows: assume each period is a year; the current stock price is 100; there is a continuous dividend rate of q = 5%; the risk-free rate is r = 7%; and the volatility is o = 25%. This suggests a multiplicative forward tree with "up factor" u = exp(-1(-25)2 + 25) = 1.2445. Since we have set the branching probabilities to U = = 204.67 161,20 204.67 124.5 164.46 124.25 126.97 13 2.15 100 \/ 97.86 106,18 SH.83 77.07 75.42 80.22 75.42 59.40 60.60 4579 45.79 forward prices stoele prices 1/2, the "down factor" must be d= 2 u = .7555. The stock tree is determined by the forward tree, st = Fye-(1-2)(T-t).13 (a) Value an American call with strike 90 and maturity 3 years. (b) Value a call with strike 95 on the average year-end stock price. (This option's payoff at time T = 3 is max{(81 +82 +83)/3 95,0}.) (c) Value a down and out barrier call with barrier 85 and strike 95. (This option is worthless if s1, 82, or $3 is below 85; otherwise its payoff at time T = 3 is (33 95)+-) (7) This problem asks you to value some path-dependent options using one of the meth- ods discussed in the Section 7 notes. Use the 3-period forward and stock price trees shown in the figure, with branching probabilities equal to 1/2. [The trees were es- tablished as follows: assume each period is a year; the current stock price is 100; there is a continuous dividend rate of q = 5%; the risk-free rate is r = 7%; and the volatility is o = 25%. This suggests a multiplicative forward tree with "up factor" u = exp(-1(-25)2 + 25) = 1.2445. Since we have set the branching probabilities to U = = 204.67 161,20 204.67 124.5 164.46 124.25 126.97 13 2.15 100 \/ 97.86 106,18 SH.83 77.07 75.42 80.22 75.42 59.40 60.60 4579 45.79 forward prices stoele prices 1/2, the "down factor" must be d= 2 u = .7555. The stock tree is determined by the forward tree, st = Fye-(1-2)(T-t).13 (a) Value an American call with strike 90 and maturity 3 years. (b) Value a call with strike 95 on the average year-end stock price. (This option's payoff at time T = 3 is max{(81 +82 +83)/3 95,0}.) (c) Value a down and out barrier call with barrier 85 and strike 95. (This option is worthless if s1, 82, or $3 is below 85; otherwise its payoff at time T = 3 is (33 95)+-)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts