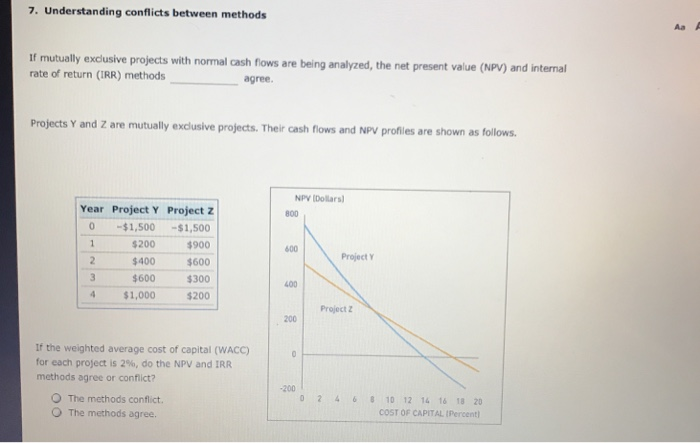

Question: 7. Understanding conflicts between methods Aa A usive projects with normal cash flows are being analyzed, the net present value (NPV) and intenal rate of

7. Understanding conflicts between methods Aa A usive projects with normal cash flows are being analyzed, the net present value (NPV) and intenal rate of return (IRR) methods agree. Projects Y and Z are mutually exclusive projects. Their cash flows and NPV profiles are shown as follows NPV (Dollars Year Project Y Project Z 800 0 $1,500 1,500 $200 $900 $600 $600 $300 4 $1,000 $200 600 $400 Project Y 400 Project 2 200 If the weighted average cost of capital (WACC) for each project is 2%, do the NPV and IRR methods agree or confilict? -200 O The methods conflict. The methods agree. 0246 10 12 14 16 18 20 COST OF CAPITAL IPercent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts