Question: The option for First multiple choice : Never, sometimes, always The options are 2 & third are visible and are the same options The option

The option for First multiple choice :

Never, sometimes, always

The options are 2 & third are visible and are the same options

The option for the 4th choice : NPV or IRR method

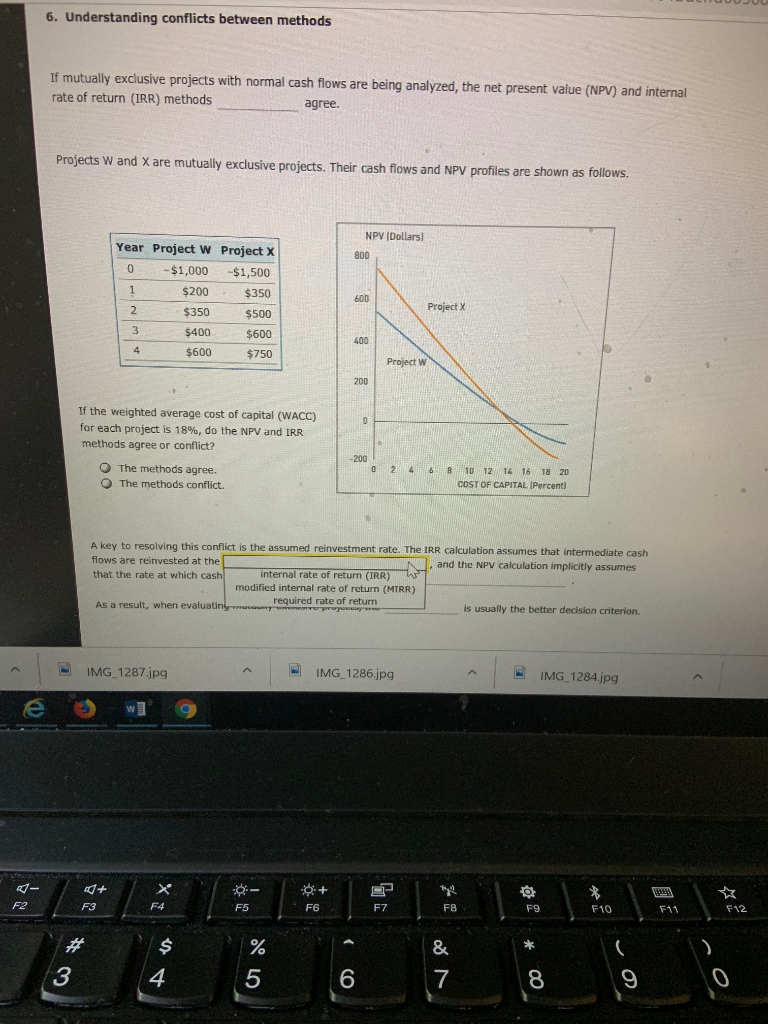

6. Understanding conflicts between methods If mutually exclusive projects with normal cash flows are being analyzed, the net present value (NPV) and internal rate of return (IRR) methods agree. Projects W and X are mutually exclusive projects. Their cash flows and NPV profiles are shown as follows NPV IDollars Year Project W Project X 900 0 -$1,000 -$1,500 $200 $350 600 Project X 2 $350 $500 3 $400 $600 600 4 $600 $750 Project W 200 the weighted average cost of capital (WACC) for each project is 18% , do the NPV and IRR methods agree or conflict? 200 O The methods agree. O The methods conflict. 0 2 4 68 10 12 14 16 18 20 COST OF CAPITAL (Percent) A key to resolving this conflict the assumed reinvestment rate. The IRR calculation assumes that intermediate cash flows are reinvested the that the rate which cash morte idi rate of return (IRR) and the NPV calculation implicitly assumes (MTRR) required rate of return ay As a result, when evaluatin projes is usually the better decision criterion. IMG 1287.jpg IMG 1286.jpg IMG 1284.jpq + + ww F2 F3 F4 F5 F6 F7 F8 F9 F10 F12 F11 & 3 4 6 9 7 8 LO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts