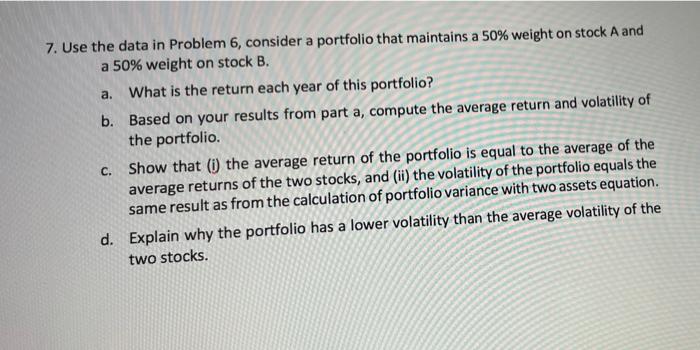

Question: 7. Use the data in Problem 6, consider a portfolio that maintains a 50% weight on stock A and a 50% weight on stock B.

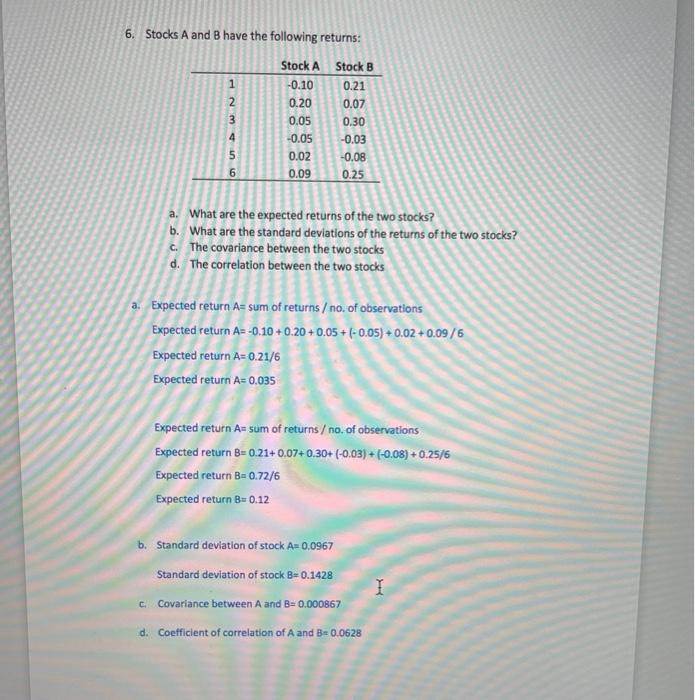

7. Use the data in Problem 6, consider a portfolio that maintains a 50% weight on stock A and a 50% weight on stock B. What is the return each year of this portfolio? a. b. Based on your results from part a, compute the average return and volatility of the portfolio Show that (i) the average return of the portfolio is equal to the average of the average returns of the two stocks, and (ii) the volatility of the portfolio equals the same result as from the calculation of portfolio variance with two assets equation. C. d. Explain why the portfolio has a lower volatility than the average volatility of the two stocks. 6. Stocks A and B have the following returns: Stock A Stock B 1 0.21 -0.10 0.20 0.07 0.05 0.30 OWN -0.05 -0.03 0.02 -0.08 0.09 0.25 a. What are the expected returns of the two stocks? b. What are the standard deviations of the returns of the two stocks? C. The covariance between the two stocks d. The correlation between the two stocks a. Expected return A= sum of returns / no. of observations Expected return A= -0,10 +0.20 +0.05 + - 0.05) + 0.02 +0.09 /6 Expected return A=0.21/6 Expected return A= 0.035 Expected return A= sum of returns / no. of observations Expected return B=0.21+0.07+0.30+ (-0.03) + (-0.08) +0.25/6 Expected return B=0.72/6 Expected return B 0.12 b. Standard deviation of stock A+ 0.0967 Standard deviation of stock B=0.1428 I c. Covariance between A and B= 0.000867 d. Coefficient of correlation of A and B=0.0628

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts