Question: 7 Video Lesson 2) yeild to maturity /8 Step 3: Practice: Yield to Maturity and Future Price Now it's time for you to practice what

7 Video Lesson 2) yeild to maturity

/8

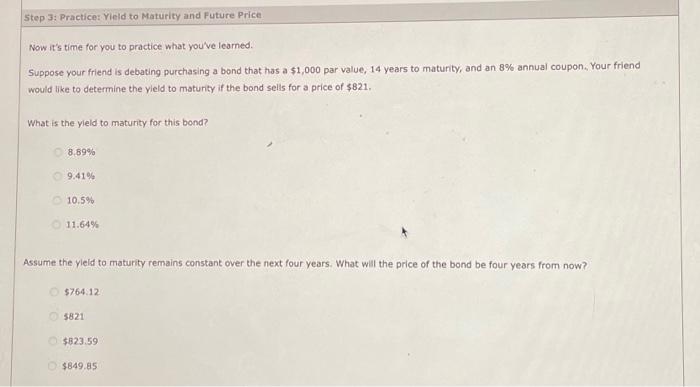

Step 3: Practice: Yield to Maturity and Future Price Now it's time for you to practice what you've learned. Suppose your friend is debating purchasing a bond that has a $1,000 par value, 14 years to maturity, and an 8% annual coupon.. Your friend would like to determine the yield to maturity if the bond sells for a price of $821. What is the yield to maturity for this bond? 8.89% 9.41% 10.5% 11.64% Assume the yield to maturity remains constant over the next four years. What will the price of the bond be four years from now? $764.12 $821 $823.59 $849.85

Now it's time for you to practice what you've learned. Suppose your friend is debating purchasing a bond that has a $1,000 par value, 14 years to maturity, and an 8% annual coupon, Your friend would tike to determine the yield to maturity if the bond sells for a price of $821. What is the yleld to maturity for this bond? 8,89% 9.41% 10.5% 11.64% Assume the yleld to maturity remains constant over the next four years. What will the price of the bond be four years from now? $764:12 $821 $823.59 $849.45

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock