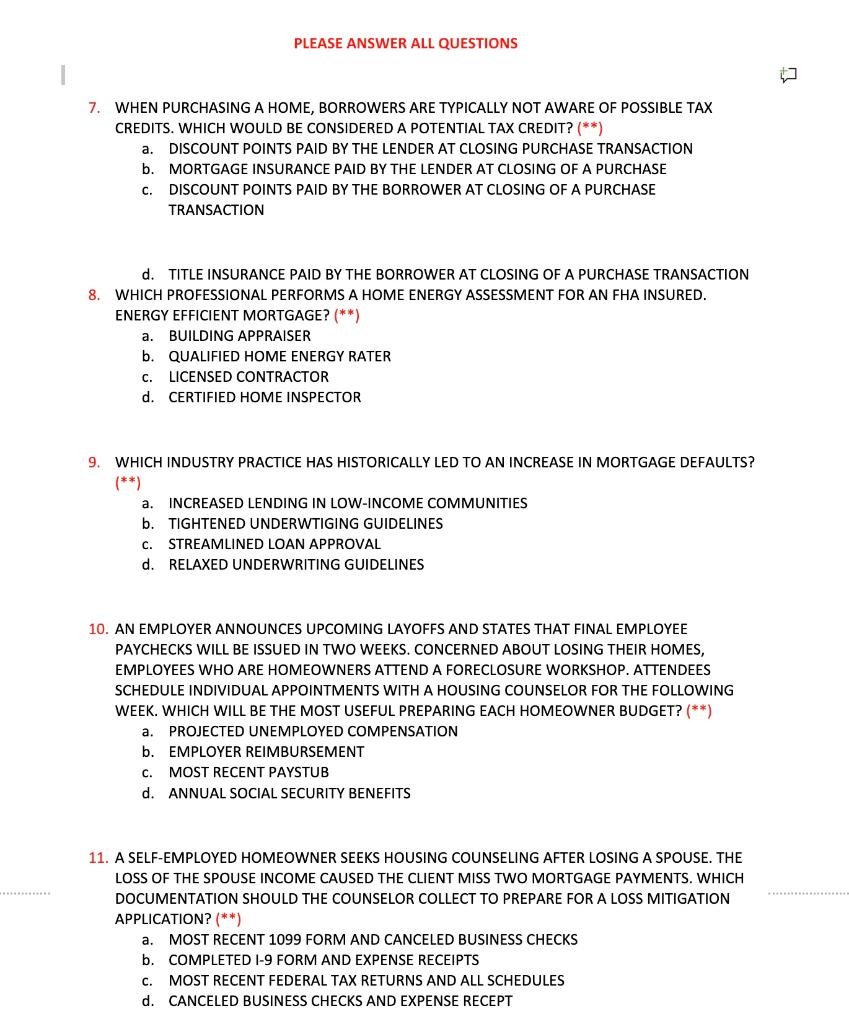

Question: 7. WHEN PURCHASING A HOME, BORROWERS ARE TYPICALLY NOT AWARE OF POSSIBLE TAX CREDITS. WHICH WOULD BE CONSIDERED A POTENTIAL TAX CREDIT? ( ) a.

7. WHEN PURCHASING A HOME, BORROWERS ARE TYPICALLY NOT AWARE OF POSSIBLE TAX CREDITS. WHICH WOULD BE CONSIDERED A POTENTIAL TAX CREDIT? ( ) a. DISCOUNT POINTS PAID BY THE LENDER AT CLOSING PURCHASE TRANSACTION b. MORTGAGE INSURANCE PAID BY THE LENDER AT CLOSING OF A PURCHASE c. DISCOUNT POINTS PAID BY THE BORROWER AT CLOSING OF A PURCHASE TRANSACTION d. TITLE INSURANCE PAID BY THE BORROWER AT CLOSING OF A PURCHASE TRANSACTION 8. WHICH PROFESSIONAL PERFORMS A HOME ENERGY ASSESSMENT FOR AN FHA INSURED. ENERGY EFFICIENT MORTGAGE? ) a. BUILDING APPRAISER b. QUALIFIED HOME ENERGY RATER c. LICENSED CONTRACTOR d. CERTIFIED HOME INSPECTOR 9. WHICH INDUSTRY PRACTICE HAS HISTORICALLY LED TO AN INCREASE IN MORTGAGE DEFAULTS? () a. INCREASED LENDING IN LOW-INCOME COMMUNITIES b. TIGHTENED UNDERWTIGING GUIDELINES c. STREAMLINED LOAN APPROVAL d. RELAXED UNDERWRITING GUIDELINES 10. AN EMPLOYER ANNOUNCES UPCOMING LAYOFFS AND STATES THAT FINAL EMPLOYEE PAYCHECKS WILL BE ISSUED IN TWO WEEKS. CONCERNED ABOUT LOSING THEIR HOMES, EMPLOYEES WHO ARE HOMEOWNERS ATTEND A FORECLOSURE WORKSHOP. ATTENDEES SCHEDULE INDIVIDUAL APPOINTMENTS WITH A HOUSING COUNSELOR FOR THE FOLLOWING WEEK. WHICH WILL BE THE MOST USEFUL PREPARING EACH HOMEOWNER BUDGET? ( ) a. PROJECTED UNEMPLOYED COMPENSATION b. EMPLOYER REIMBURSEMENT c. MOST RECENT PAYSTUB d. ANNUAL SOCIAL SECURITY BENEFITS 11. A SELF-EMPLOYED HOMEOWNER SEEKS HOUSING COUNSELING AFTER LOSING A SPOUSE. THE LOSS OF THE SPOUSE INCOME CAUSED THE CLIENT MISS TWO MORTGAGE PAYMENTS. WHICH DOCUMENTATION SHOULD THE COUNSELOR COLLECT TO PREPARE FOR A LOSS MITIGATION APPLICATION? ) a. MOST RECENT 1099 FORM AND CANCELED BUSINESS CHECKS b. COMPLETED I-9 FORM AND EXPENSE RECEIPTS c. MOST RECENT FEDERAL TAX RETURNS AND ALL SCHEDULES d. CANCELED BUSINESS CHECKS AND EXPENSE RECEPT 7. WHEN PURCHASING A HOME, BORROWERS ARE TYPICALLY NOT AWARE OF POSSIBLE TAX CREDITS. WHICH WOULD BE CONSIDERED A POTENTIAL TAX CREDIT? ( ) a. DISCOUNT POINTS PAID BY THE LENDER AT CLOSING PURCHASE TRANSACTION b. MORTGAGE INSURANCE PAID BY THE LENDER AT CLOSING OF A PURCHASE c. DISCOUNT POINTS PAID BY THE BORROWER AT CLOSING OF A PURCHASE TRANSACTION d. TITLE INSURANCE PAID BY THE BORROWER AT CLOSING OF A PURCHASE TRANSACTION 8. WHICH PROFESSIONAL PERFORMS A HOME ENERGY ASSESSMENT FOR AN FHA INSURED. ENERGY EFFICIENT MORTGAGE? ) a. BUILDING APPRAISER b. QUALIFIED HOME ENERGY RATER c. LICENSED CONTRACTOR d. CERTIFIED HOME INSPECTOR 9. WHICH INDUSTRY PRACTICE HAS HISTORICALLY LED TO AN INCREASE IN MORTGAGE DEFAULTS? () a. INCREASED LENDING IN LOW-INCOME COMMUNITIES b. TIGHTENED UNDERWTIGING GUIDELINES c. STREAMLINED LOAN APPROVAL d. RELAXED UNDERWRITING GUIDELINES 10. AN EMPLOYER ANNOUNCES UPCOMING LAYOFFS AND STATES THAT FINAL EMPLOYEE PAYCHECKS WILL BE ISSUED IN TWO WEEKS. CONCERNED ABOUT LOSING THEIR HOMES, EMPLOYEES WHO ARE HOMEOWNERS ATTEND A FORECLOSURE WORKSHOP. ATTENDEES SCHEDULE INDIVIDUAL APPOINTMENTS WITH A HOUSING COUNSELOR FOR THE FOLLOWING WEEK. WHICH WILL BE THE MOST USEFUL PREPARING EACH HOMEOWNER BUDGET? ( ) a. PROJECTED UNEMPLOYED COMPENSATION b. EMPLOYER REIMBURSEMENT c. MOST RECENT PAYSTUB d. ANNUAL SOCIAL SECURITY BENEFITS 11. A SELF-EMPLOYED HOMEOWNER SEEKS HOUSING COUNSELING AFTER LOSING A SPOUSE. THE LOSS OF THE SPOUSE INCOME CAUSED THE CLIENT MISS TWO MORTGAGE PAYMENTS. WHICH DOCUMENTATION SHOULD THE COUNSELOR COLLECT TO PREPARE FOR A LOSS MITIGATION APPLICATION? ) a. MOST RECENT 1099 FORM AND CANCELED BUSINESS CHECKS b. COMPLETED I-9 FORM AND EXPENSE RECEIPTS c. MOST RECENT FEDERAL TAX RETURNS AND ALL SCHEDULES d. CANCELED BUSINESS CHECKS AND EXPENSE RECEPT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts