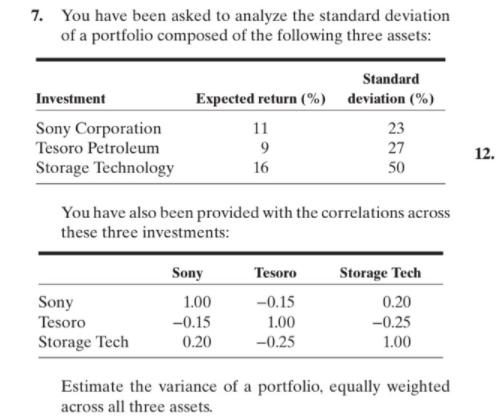

Question: 7. You have been asked to analyze the standard deviation of a portfolio composed of the following three assets: Standard Investment Expected return (%)

7. You have been asked to analyze the standard deviation of a portfolio composed of the following three assets: Standard Investment Expected return (%) deviation (%) Sony Corporation Tesoro Petroleum 23 27 11 12. Storage Technology 16 50 You have also been provided with the correlations across these three investments: Sony Tesoro Storage Tech Sony 1.00 -0.15 0.20 Tesoro -0.15 1.00 -0.25 Storage Tech 0.20 -0.25 1.00 Estimate the variance of a portfolio, equally weighted across all three assets.

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Variance of a threeasset portfolio p 2 w 1 2 1 2 w 2 2 2 2 w 3 2 3 2 2w 1 w 2 Cov 12 2... View full answer

Get step-by-step solutions from verified subject matter experts