Question: 70) Both assets B and C plot on the SML. Asset B has a beta of 1.3 and an expected return of 13.1%. Asset C

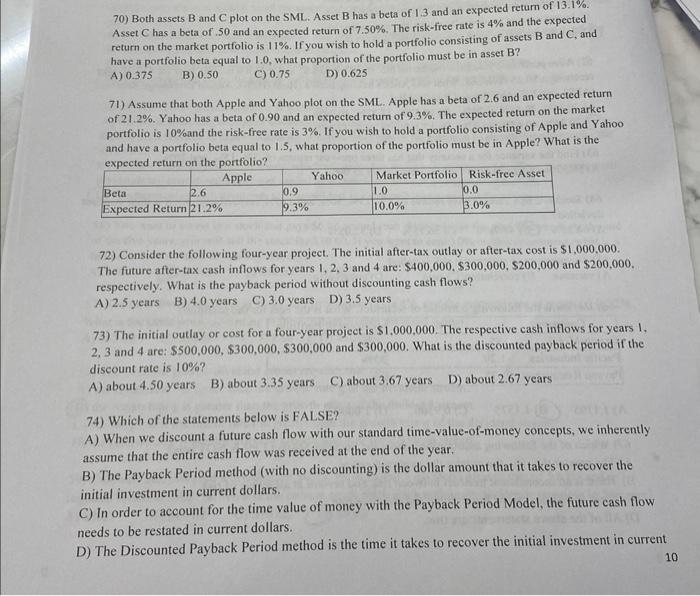

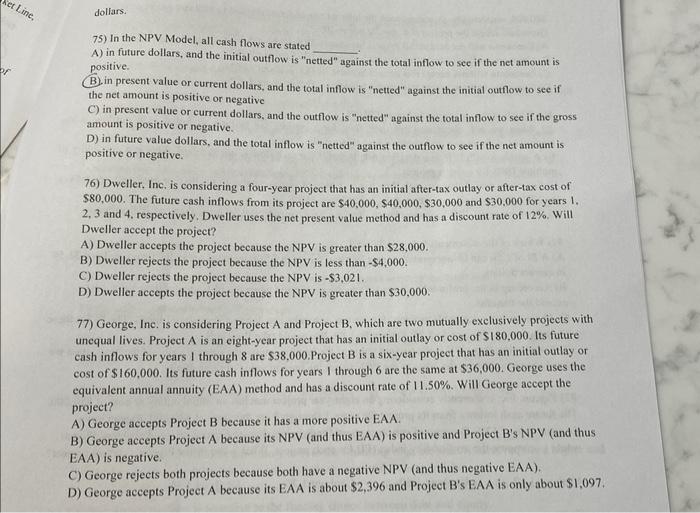

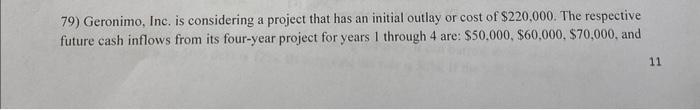

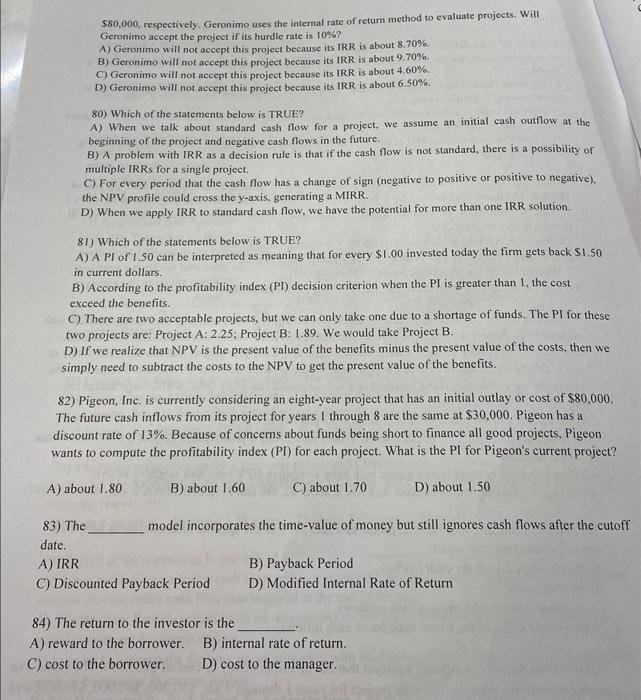

70) Both assets B and C plot on the SML. Asset B has a beta of 1.3 and an expected return of 13.1%. Asset C has a beta of .50 and an expected return of 7.50%. The risk-free rate is 4% and the expected return on the market portfolio is 11%. If you wish to hold a portfolio consisting of assets B and C, and have a portfolio beta equal to 1.0 , what proportion of the portfolio must be in asset B? A) 0.375 B) 0.50 C) 0.75 D) 0.625 71) Assume that both Apple and Yahoo plot on the SML. Apple has a beta of 2.6 and an expected retum of 21.2%. Yahoo has a beta of 0.90 and an expected return of 9.3%. The expected return on the market portfolio is 10% and the risk-free rate is 3%. If you wish to hold a portfolio consisting of Apple and Yahoo and have a portfolio beta equal to 1.5, what proportion of the portfolio must be in Apple? What is the 72) Consider the following four-year project. The initial after-tax outlay or after-tax cost is $1,000,000. The future after-tax cash inflows for years 1,2,3 and 4 are: $400,000,$300,000,$200,000 and $200,000. respectively. What is the payback period without discounting cash flows? A) 2.5 years B) 4.0 years C) 3.0 years D) 3.5 years 73) The initial outlay or cost for a four-year project is $1,000,000. The respective cash inflows for years 1 . 2,3 and 4 are: $500,000,$300,000,$300,000 and $300,000. What is the discounted payback period if the discount rate is 10% ? A) about 4.50 years B) about 3.35 years C) about 3.67 years D) about 2.67 years 74) Which of the statements below is FALSE? A) When we discount a future cash flow with our standard time-value-of-money concepts, we inherently assume that the entire cash flow was received at the end of the year. B) The Payback Period method (with no discounting) is the dollar amount that it takes to recover the initial investment in current dollars. C) In order to account for the time value of money with the Payback Period Model, the future cash flow needs to be restated in current dollars. D) The Discounted Payback Period method is the time it takes to recover the initial investment in current 10 75) In the NPV Model, all cash flows are stated A) in future dollars, and the initial outflow is "netted" against the total inflow to see if the net amount is positive. B. in present value or current dollars, and the total inflow is "netted" against the initial outflow to see if the net amount is positive or negative C) in present value or eurrent dollars, and the outflow is "netted" against the total inflow to see if the gross amount is positive or negative. D) in future value dollars, and the total inflow is "netted" against the outflow to see if the net amount is positive or negative. 76) Dweller, Inc. is considering a four-year project that has an initial after-tax outlay or after-tax cost of $80,000. The future cash inflows from its project are $40,000,$40,000,$30,000 and $30,000 for years 1 . 2, 3 and 4. respectively. Dweller uses the net present value method and has a discount rate of 12%. Will Dweller accept the project? A) Dweller accepts the project because the NPV is greater than $28,000. B) Dweller rejects the project because the NPV is less than $4,000. C) Dweller rejects the project because the NPV is $3,021. D) Dweller aceepts the project because the NPV is greater than $30,000. 77) George, Ine. is considering Project A and Project B, which are two mutually exclusively projects with unequal lives. Project A is an eight-year project that has an initial outlay or cost of $180,000. Its future cash inflows for years 1 through 8 are $38,000. Project B is a six-year project that has an initial outlay or cost of $160,000. Its future cash inflows for years I through 6 are the same at $36,000. George uses the equivalent annual annuity (EAA) method and has a discount rate of 11.50%. Will George accept the project? A) George accepts Project B because it has a more positive EAA. B) George accepts Project A because its NPV (and thus EAA) is positive and Project B's NPV (and thus EAA) is negative. C) George rejects both projects because both have a negative NPV (and thus negative EAA). D) George accepts Project A because its EAA is about \$2,396 and Project B's EAA is only about \$1,097. 79) Geronimo, Inc. is considering a project that has an initial outlay or cost of $220,000. The respective future cash inflows from its four-year project for years 1 through 4 are: $50,000,$60,000,$70,000, and $80,000, respectively. Geronimo uses the internal rate of retum method to evaluate projects, Will Geronimo accept the projeet if its hurdle rate is 10% ? A) Geronimo will not accept this project because its IRR is about 8.70%. B) Geronimo will not accept this project because its IRR is about 9.70%. C) Geronimo will not aceept this project because its IRR is about 4.60%. D) Geronimo will not accept this project because its IRR is about 6.50%. 80) Which of the statements below is TRUE? A) When we talk about standard eash flow for a project, we assume an initial cash outflow at the begimning of the project and negative cash flows in the future. B) A problem with IRR as a decision rale is that if the cash flow is not standard, there is a possibility of multiple IRRs for a single project. C) For every period that the cash flow has a change of sign (negative to positive or positive to negative). the NPV profile could cross the y-axis, generating a MIRR. D) When we apply IRR to standard cash flow, we have the potential for more than one IRR solution. 81) Which of the statements below is TRUE? A) A PI of 1.50 can be interpreted as meaning that for every $1.00 invested today the firm gets back $1.50 in current dollars. B) According to the profitability index (PI) decision criterion when the PI is greater than 1 , the cost exceed the benefits. C) There are two acceptable projects, but we can only take one due to a shortage of funds. The PI for these two projects are: Project A:2.25; Project B:1.89. We would take Project B. D) If we realize that NPV is the present value of the benefits minus the present value of the costs, then we simply need to subtract the costs to the NPV to get the present value of the benefits. 82) Pigeon, Inc. is currently considering an eight-year project that has an initial outlay or cost of $80,000. The future cash inflows from its project for years I through 8 are the same at $30,000. Pigeon has a discount rate of 13%. Because of concerns about funds being short to finance all good projects, Pigeon wants to compute the profitability index (PI) for each project. What is the PI for Pigeon's current project? A) about 1.80 B) about 1.60 C) about 1.70 D) about 1.50 83) The model incorporates the time-value of money but still ignores cash flows after the cutoff date. A) IRR B) Payback Period C) Discounted Payback Period D) Modified Internal Rate of Return 84) The return to the investor is the A) reward to the borrower. B) internal rate of return. C) cost to the borrower. D) cost to the manager. 70) Both assets B and C plot on the SML. Asset B has a beta of 1.3 and an expected return of 13.1%. Asset C has a beta of .50 and an expected return of 7.50%. The risk-free rate is 4% and the expected return on the market portfolio is 11%. If you wish to hold a portfolio consisting of assets B and C, and have a portfolio beta equal to 1.0 , what proportion of the portfolio must be in asset B? A) 0.375 B) 0.50 C) 0.75 D) 0.625 71) Assume that both Apple and Yahoo plot on the SML. Apple has a beta of 2.6 and an expected retum of 21.2%. Yahoo has a beta of 0.90 and an expected return of 9.3%. The expected return on the market portfolio is 10% and the risk-free rate is 3%. If you wish to hold a portfolio consisting of Apple and Yahoo and have a portfolio beta equal to 1.5, what proportion of the portfolio must be in Apple? What is the 72) Consider the following four-year project. The initial after-tax outlay or after-tax cost is $1,000,000. The future after-tax cash inflows for years 1,2,3 and 4 are: $400,000,$300,000,$200,000 and $200,000. respectively. What is the payback period without discounting cash flows? A) 2.5 years B) 4.0 years C) 3.0 years D) 3.5 years 73) The initial outlay or cost for a four-year project is $1,000,000. The respective cash inflows for years 1 . 2,3 and 4 are: $500,000,$300,000,$300,000 and $300,000. What is the discounted payback period if the discount rate is 10% ? A) about 4.50 years B) about 3.35 years C) about 3.67 years D) about 2.67 years 74) Which of the statements below is FALSE? A) When we discount a future cash flow with our standard time-value-of-money concepts, we inherently assume that the entire cash flow was received at the end of the year. B) The Payback Period method (with no discounting) is the dollar amount that it takes to recover the initial investment in current dollars. C) In order to account for the time value of money with the Payback Period Model, the future cash flow needs to be restated in current dollars. D) The Discounted Payback Period method is the time it takes to recover the initial investment in current 10 75) In the NPV Model, all cash flows are stated A) in future dollars, and the initial outflow is "netted" against the total inflow to see if the net amount is positive. B. in present value or current dollars, and the total inflow is "netted" against the initial outflow to see if the net amount is positive or negative C) in present value or eurrent dollars, and the outflow is "netted" against the total inflow to see if the gross amount is positive or negative. D) in future value dollars, and the total inflow is "netted" against the outflow to see if the net amount is positive or negative. 76) Dweller, Inc. is considering a four-year project that has an initial after-tax outlay or after-tax cost of $80,000. The future cash inflows from its project are $40,000,$40,000,$30,000 and $30,000 for years 1 . 2, 3 and 4. respectively. Dweller uses the net present value method and has a discount rate of 12%. Will Dweller accept the project? A) Dweller accepts the project because the NPV is greater than $28,000. B) Dweller rejects the project because the NPV is less than $4,000. C) Dweller rejects the project because the NPV is $3,021. D) Dweller aceepts the project because the NPV is greater than $30,000. 77) George, Ine. is considering Project A and Project B, which are two mutually exclusively projects with unequal lives. Project A is an eight-year project that has an initial outlay or cost of $180,000. Its future cash inflows for years 1 through 8 are $38,000. Project B is a six-year project that has an initial outlay or cost of $160,000. Its future cash inflows for years I through 6 are the same at $36,000. George uses the equivalent annual annuity (EAA) method and has a discount rate of 11.50%. Will George accept the project? A) George accepts Project B because it has a more positive EAA. B) George accepts Project A because its NPV (and thus EAA) is positive and Project B's NPV (and thus EAA) is negative. C) George rejects both projects because both have a negative NPV (and thus negative EAA). D) George accepts Project A because its EAA is about \$2,396 and Project B's EAA is only about \$1,097. 79) Geronimo, Inc. is considering a project that has an initial outlay or cost of $220,000. The respective future cash inflows from its four-year project for years 1 through 4 are: $50,000,$60,000,$70,000, and $80,000, respectively. Geronimo uses the internal rate of retum method to evaluate projects, Will Geronimo accept the projeet if its hurdle rate is 10% ? A) Geronimo will not accept this project because its IRR is about 8.70%. B) Geronimo will not accept this project because its IRR is about 9.70%. C) Geronimo will not aceept this project because its IRR is about 4.60%. D) Geronimo will not accept this project because its IRR is about 6.50%. 80) Which of the statements below is TRUE? A) When we talk about standard eash flow for a project, we assume an initial cash outflow at the begimning of the project and negative cash flows in the future. B) A problem with IRR as a decision rale is that if the cash flow is not standard, there is a possibility of multiple IRRs for a single project. C) For every period that the cash flow has a change of sign (negative to positive or positive to negative). the NPV profile could cross the y-axis, generating a MIRR. D) When we apply IRR to standard cash flow, we have the potential for more than one IRR solution. 81) Which of the statements below is TRUE? A) A PI of 1.50 can be interpreted as meaning that for every $1.00 invested today the firm gets back $1.50 in current dollars. B) According to the profitability index (PI) decision criterion when the PI is greater than 1 , the cost exceed the benefits. C) There are two acceptable projects, but we can only take one due to a shortage of funds. The PI for these two projects are: Project A:2.25; Project B:1.89. We would take Project B. D) If we realize that NPV is the present value of the benefits minus the present value of the costs, then we simply need to subtract the costs to the NPV to get the present value of the benefits. 82) Pigeon, Inc. is currently considering an eight-year project that has an initial outlay or cost of $80,000. The future cash inflows from its project for years I through 8 are the same at $30,000. Pigeon has a discount rate of 13%. Because of concerns about funds being short to finance all good projects, Pigeon wants to compute the profitability index (PI) for each project. What is the PI for Pigeon's current project? A) about 1.80 B) about 1.60 C) about 1.70 D) about 1.50 83) The model incorporates the time-value of money but still ignores cash flows after the cutoff date. A) IRR B) Payback Period C) Discounted Payback Period D) Modified Internal Rate of Return 84) The return to the investor is the A) reward to the borrower. B) internal rate of return. C) cost to the borrower. D) cost to the manager

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts