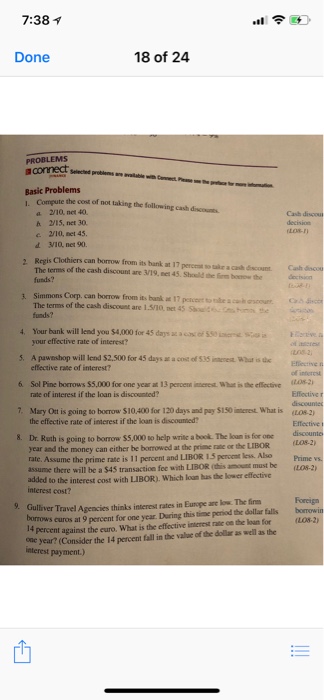

Question: 7:38 Done 18 of 24 correct ane available wih Basic Problems L Compute the cost of not taking the following cash discoums 210, net 40

7:38 Done 18 of 24 correct ane available wih Basic Problems L Compute the cost of not taking the following cash discoums 210, net 40 a h 2/15, net 30 e 2/10, net 45 d VI0, net 90. 2 Regis Clothiers can The terms of the cash discount are 3/19, net 45. Shouild the im borw the decision funds? 3. Simmons Corp, can borrow from it, hank ax 17 pacer to nbe a The terms of the cash disc? are 15/10, net 45 Sbwe's, funds? 4. Your bank will lend you $4,000 for 45 days at a ca of 550 5. A pawashop will lend $2.500 for 45 days a a cost of 535 innenest Wat is e 6 Sol Pine borrows $5,000 for one year at 13 percens inerest Whut is the effective 7. Mary Ost is going to borou $10.400 for 120 days and pay $1.50 interest. What is 8. Dr.Ruth is going to borrow S5,000 to help write a book. The lan is front your effective rate of interest? effective rate of interest? of interest rate of interest if the loan is discounted the effective rate of interest if the loan is discounmed Effective discounte Los-2) year and the money can either be borrowed at the prime rate or the LIBOR rate. Assume the prime rate is 11 percent and LIBOR 15 percost less. assume there will be a $45 transaction fee with LIBOR (this amoust must be (LO8-2) o the interest cost with LIBOR). Which loan has the lower effective interest cost? Gulliver Travel Agencies thinks interest rates in Eungpe are kou: The im borrows curos at 9 percent for one year During this time period the dollar falls bomrowi 14 percent against the euro. What is the effective interest ratie on the loan for e year? (Consider the 14 percent fall in the value of the dollar as well as the interest payment.) Foreign 9. L08-2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts