Question: 7.5 After using a Machine A for 5 years, the company has an opportu- nity to purchase Machine B, which would replace Machine A. Machine

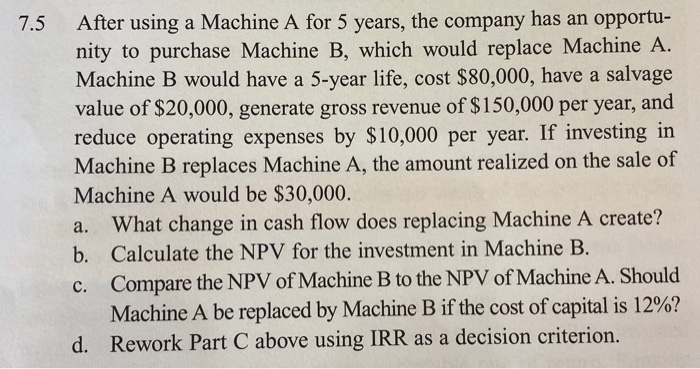

7.5 After using a Machine A for 5 years, the company has an opportu- nity to purchase Machine B, which would replace Machine A. Machine B would have a 5-year life, cost $80,000, have a salvage value of $20,000, generate gross revenue of $150,000 per year, and reduce operating expenses by $10,000 per year. If investing in Machine B replaces Machine A, the amount realized on the sale of Machine A would be $30,000. a. What change in cash flow does replacing Machine A create? b. Calculate the NPV for the investment in Machine B. c. Compare the NPV of Machine B to the NPV of Machine A. Should Machine A be replaced by Machine B if the cost of capital is 12%? d. Rework Part C above using IRR as a decision criterion. 7.5 After using a Machine A for 5 years, the company has an opportu- nity to purchase Machine B, which would replace Machine A. Machine B would have a 5-year life, cost $80,000, have a salvage value of $20,000, generate gross revenue of $150,000 per year, and reduce operating expenses by $10,000 per year. If investing in Machine B replaces Machine A, the amount realized on the sale of Machine A would be $30,000. a. What change in cash flow does replacing Machine A create? b. Calculate the NPV for the investment in Machine B. c. Compare the NPV of Machine B to the NPV of Machine A. Should Machine A be replaced by Machine B if the cost of capital is 12%? d. Rework Part C above using IRR as a decision criterion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts