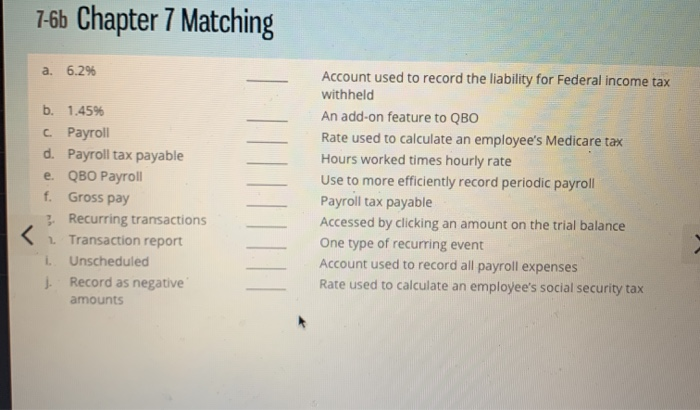

Question: 7-6b Chapter 7 Matching a. 6.2% b. 1.45% c Payroll d. Payroll tax payable e. QBO Payroll f. Gross pay 3. Recurring transactions Transaction report

7-6b Chapter 7 Matching a. 6.2% b. 1.45% c Payroll d. Payroll tax payable e. QBO Payroll f. Gross pay 3. Recurring transactions Transaction report i. Unscheduled J. Record as negative amounts Account used to record the liability for Federal income tax withheld An add-on feature to QBO Rate used to calculate an employee's Medicare tax Hours worked times hourly rate Use to more efficiently record periodic payroll Payroll tax payable Accessed by clicking an amount on the trial balance One type of recurring event Account used to record all payroll expenses Rate used to calculate an employee's social security tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts