Question: 7/8/9/10 How does a fixed rate loan differ from a floating rate loan? A fixed rate loan can only be taken out for a car.

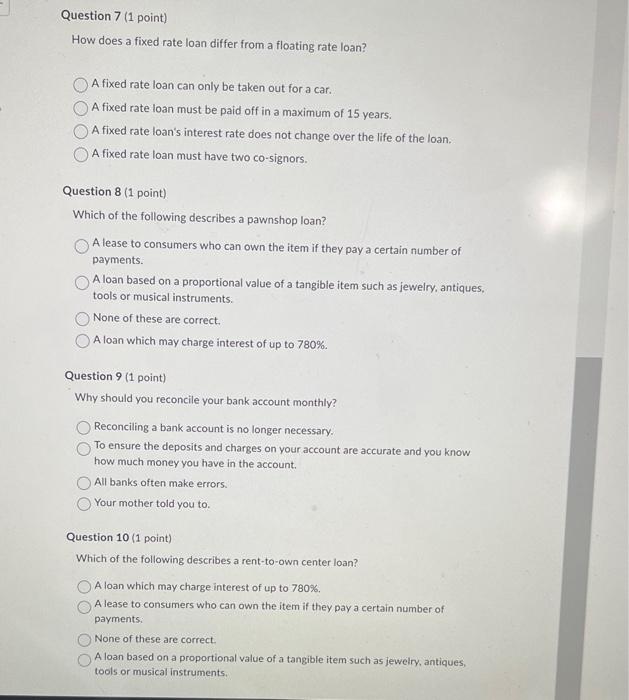

How does a fixed rate loan differ from a floating rate loan? A fixed rate loan can only be taken out for a car. A fixed rate loan must be paid off in a maximum of 15 years. A fixed rate loan's interest rate does not change over the life of the loan. A fixed rate loan must have two co-signors. Question 8 (1 point) Which of the following describes a pawnshop loan? A lease to consumers who can own the item if they pay a certain number of payments. A loan based on a proportional value of a tangible item such as jewelry, antiques. tools or musical instruments. None of these are correct. A loan which may charge interest of up to 780%. Question 9 (1 point) Why should you reconcile your bank account monthly? Reconciling a bank account is no longer necessary. To ensure the deposits and charges on your account are accurate and you know how much money you have in the account. All banks often make errors. Your mother told you to. Question 10 (1 point) Which of the following describes a rent-to-own center loan? A loan which may charge interest of up to 780%. A lease to consumers who can own the item if they pay a certain number of payments: None of these are correct. A loan based on a proportional value of a tangible item such as jewelry, antiques, tools or musical instruments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts