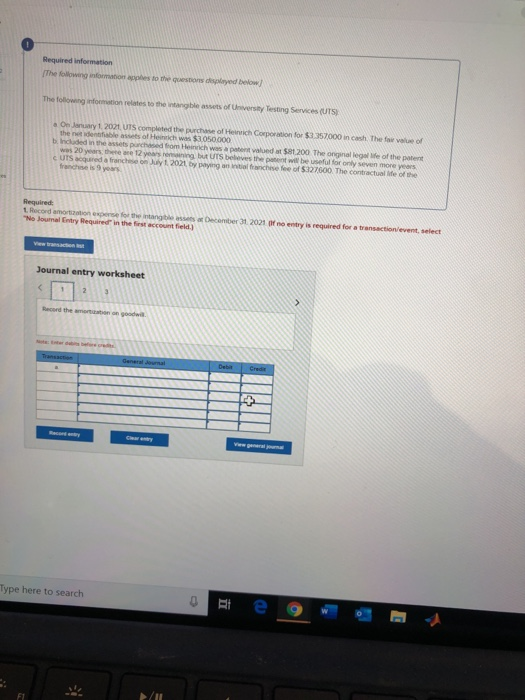

Question: 7-A record: amortization on goodwill amortization on patent amortization on franchise rights 7-B below Required information (The following information apphes to the questions displyed below

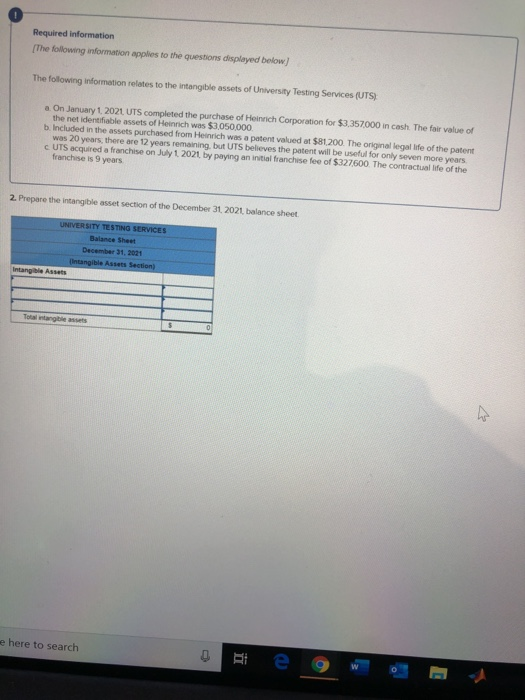

Required information (The following information apphes to the questions displyed below The followeng information relates to the intangble assets of University Testing Services (UTS) a On January 1, 2021 UTS completed the purchase of Heinrich Coporation for $3357000 in cash The far value of the net dentfiable assets of Heinrich was $3050000 b Incladed in the assets purchased rom Heinrich was a patert valued at S8t200 The onginal legal fe of the patent was 20 years there are 12 years nening but UTS beleves the patent will be useful for only seven more years c UTS acqured a franchise on July 1, 2021 by paying an iniol fanchse fee of $327600 The contractual Me of the franche is 9 years Required 1 Record amortization expise for the intangible assets at December 31 2021 fno entry is required for a transactionlevent, selects "No Joumal ntry Required in the frst account feld) Vew transacon ast Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts