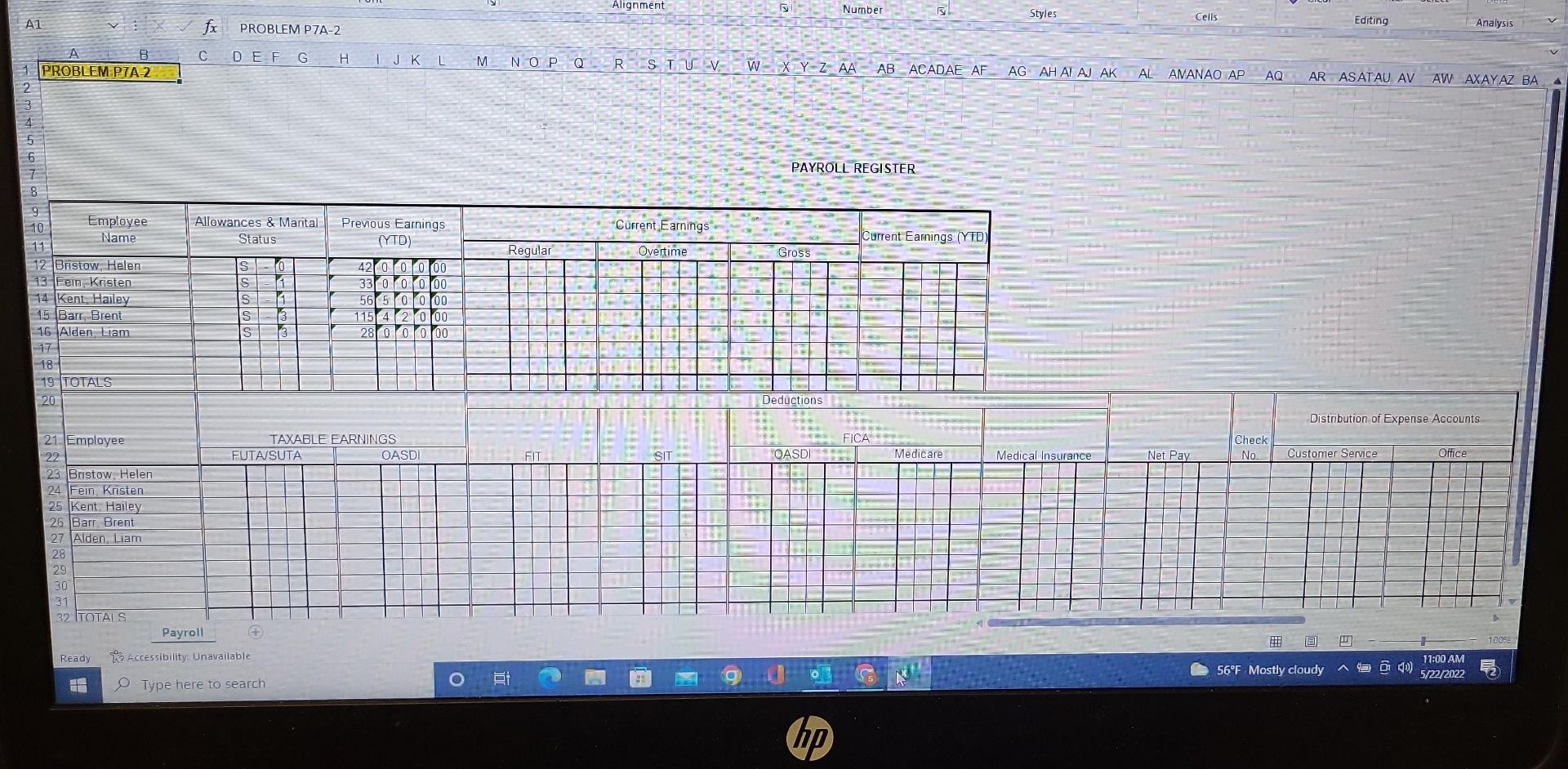

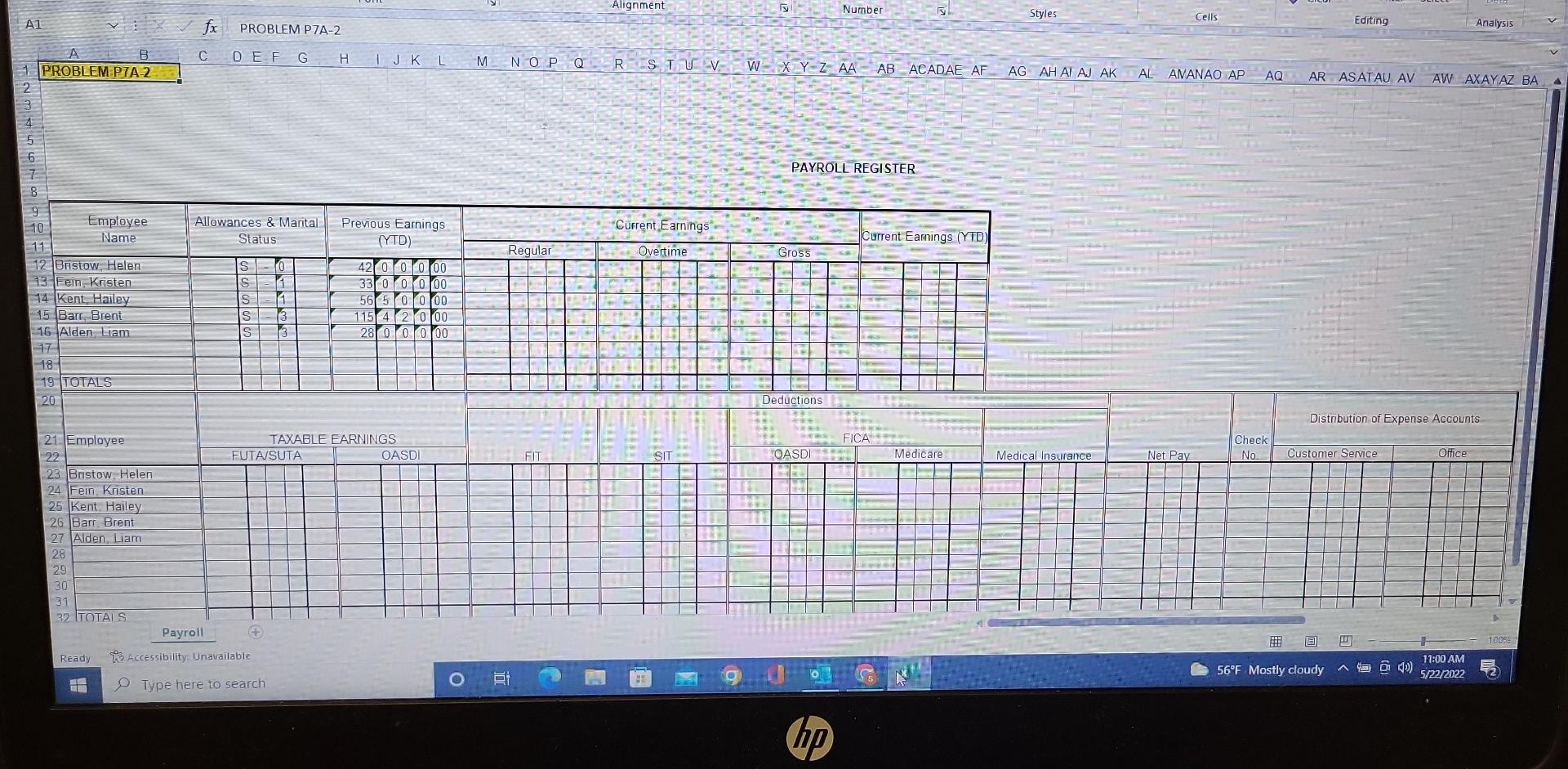

Question: 7a-2 A1 A B 1 PROBLEM PTA-2 Employee Name 11 12 Bristow. Helen 13 Fein, Kristen 14 Kent, Hailey 15 Barr, Brent 16 Alden, Liam

7a-2

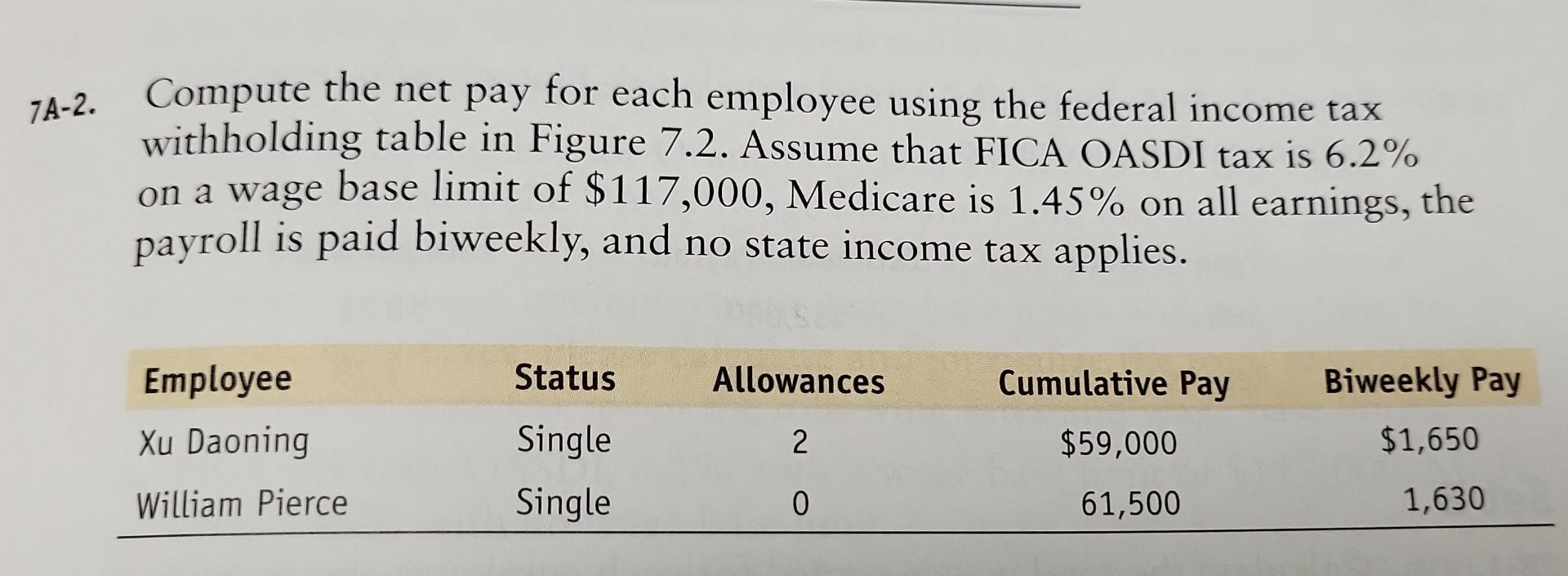

A1 A B 1 PROBLEM PTA-2 Employee Name 11 12 Bristow. Helen 13 Fein, Kristen 14 Kent, Hailey 15 Barr, Brent 16 Alden, Liam 17 18 19 TOTALS 20 21 Employee 22 23 Bristow, Helen 24 Fein, Kristen 25 Kent. Hailey 26 Barr, Brent 27 Alden, Liam 28 29 30 31 32 TOTALS Ready 66LFGAWN 3 7 8 9 10 fx PROBLEM P7A-2 CDEF G H Allowances & Marital Status S MIN 64432 1 11 Tr 13 I J K L M Regular FIT Previous Earnings (YTD) 42 0 0 0 00 33 000 00 56 5 0 0 00 115 4 2 0 00 28 000 00 S S S TAXABLE EARNINGS FUTA/SUTA Payroll + Accessibility: Unavailable Type here to search OASDI !!! C Alignment R STU V Current Earnings Overtime SIT 54 Number W X Y Z AA AB ACADAE AF PAYROLL REGISTER Gross Deductions QASDI hp Current Earnings (YTD) Medicare FICA Styles AG AH AI AJ AK Medical Insurance Cells AL AMANAO AP AQ Net Pay Editing Analysis AR ASATAU AV AW AXAYAZ BA Distribution of Expense Accounts Office Check No. 56F Mostly cloudy Customer Service 1 11:00 AM 40) 5/22/2022 100% A1 A B 1 PROBLEM PTA-2 Employee Name 11 12 Bristow. Helen 13 Fein, Kristen 14 Kent, Hailey 15 Barr, Brent 16 Alden, Liam 17 18 19 TOTALS 20 21 Employee 22 23 Bristow, Helen 24 Fein, Kristen 25 Kent. Hailey 26 Barr, Brent 27 Alden, Liam 28 29 30 31 32 TOTALS Ready 66LFGAWN 3 7 8 9 10 fx PROBLEM P7A-2 CDEF G H Allowances & Marital Status S MIN 64432 1 11 Tr 13 I J K L M Regular FIT Previous Earnings (YTD) 42 0 0 0 00 33 000 00 56 5 0 0 00 115 4 2 0 00 28 000 00 S S S TAXABLE EARNINGS FUTA/SUTA Payroll + Accessibility: Unavailable Type here to search OASDI !!! C Alignment R STU V Current Earnings Overtime SIT 54 Number W X Y Z AA AB ACADAE AF PAYROLL REGISTER Gross Deductions QASDI hp Current Earnings (YTD) Medicare FICA Styles AG AH AI AJ AK Medical Insurance Cells AL AMANAO AP AQ Net Pay Editing Analysis AR ASATAU AV AW AXAYAZ BA Distribution of Expense Accounts Office Check No. 56F Mostly cloudy Customer Service 1 11:00 AM 40) 5/22/2022 100% 7A-2. Compute the net pay for each employee using the federal income tax withholding table in Figure 7.2. Assume that FICA OASDI tax is 6.2% on a wage base limit of $117,000, Medicare is 1.45% on all earnings, the payroll is paid biweekly, and no state income tax applies. Employee Status Allowances Cumulative Pay Biweekly Pay Xu Daoning Single 2 $59,000 $1,650 William Pierce Single 0 61,500 1,630

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts