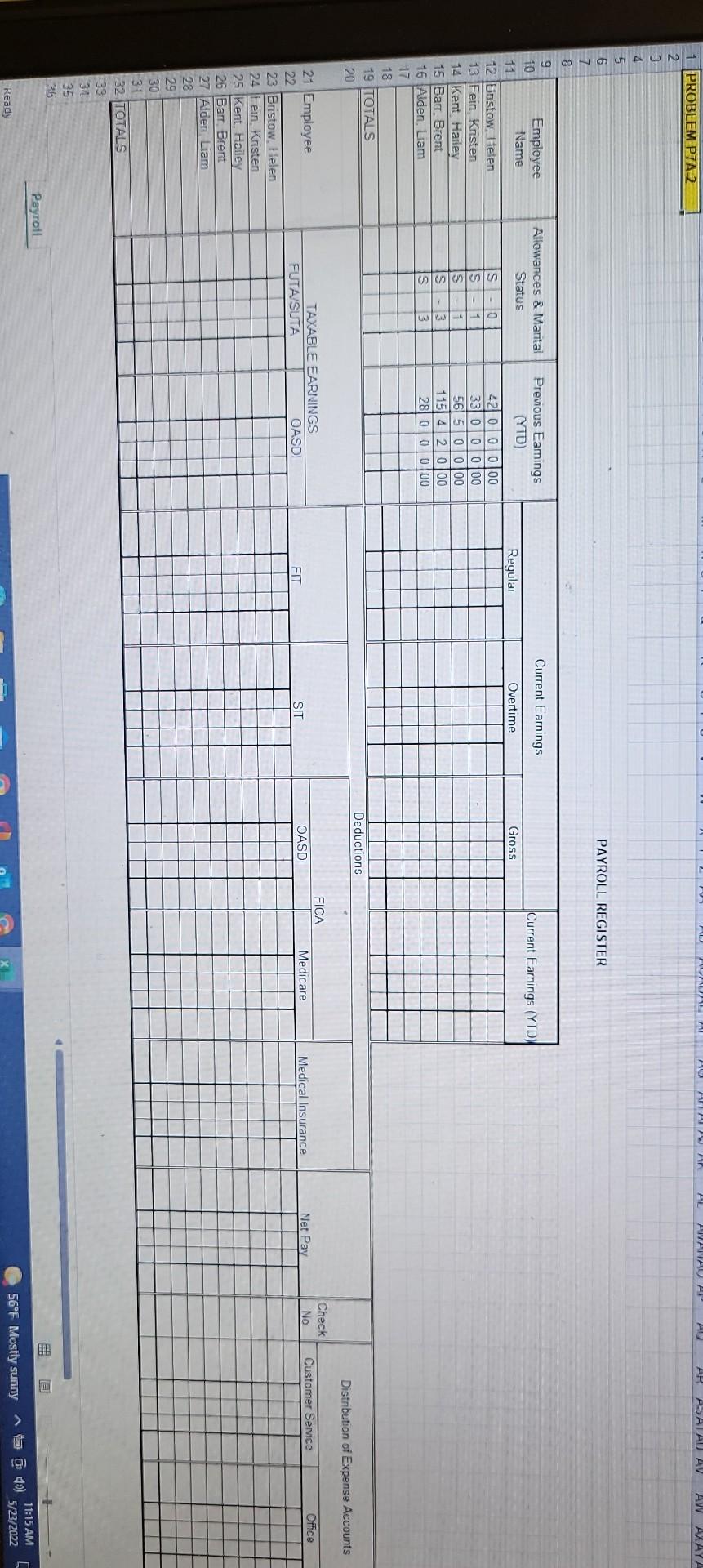

Question: 7a-2 problem 1 PROBLEM P7A-2 Employee Name 12 Bristow, Helen 13 Fein, Kristen 14 Kent, Hailey Barr, Brent 15 16 Alden, Liam 17 19 TOTALS

7a-2 problem

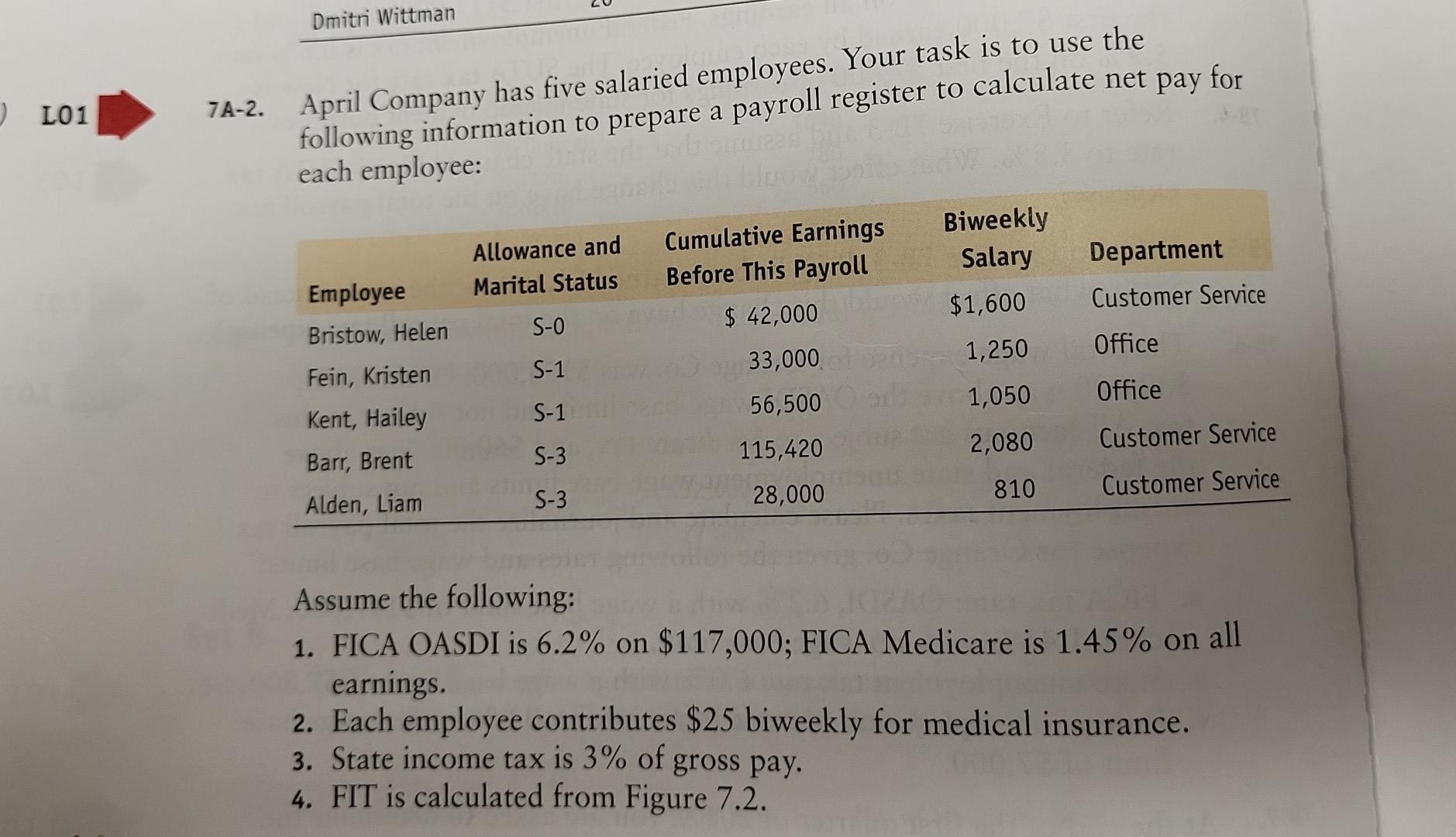

1 PROBLEM P7A-2 Employee Name 12 Bristow, Helen 13 Fein, Kristen 14 Kent, Hailey Barr, Brent 15 16 Alden, Liam 17 19 TOTALS 20 21 Employee 22 23 Bristow, Helen 24 Fein, Kristen 25 Kent, Hailey 26 Barr, Brent 27 Alden, Liam 28 29 30 31 32 TOTALS 33 7 123456NO SPINS122 8 10 11 18 35 36 Ready Allowances & Marital Status S 0 S 1 S 1 S 13 S 13 TAXABLE EARNINGS Payroll Previous Earnings (YTD) 42 000 00 33 000 00 56 500 00 115 4 2 000 28 0 0 000 FUTA/SUTA OASDI Regular FIT Current Earnings Overtime SIT PAYROLL REGISTER Gross Deductions OASDI Current Earnings (YTD) Medicare FICA AFTALAJ AN Medical Insurance. AL AMANAU AP Net Pay AU AR AS ATAU AV AW AXAYA Distribution of Expense Accounts Office Check No 56F Mostly sunny Customer Service 11:15 AM 5/23/2022 C L01 Dmitri Wittman 7A-2. April Company has five salaried employees. Your task is to use the following information to prepare a payroll register to calculate net pay for each employee: Biweekly Cumulative Earnings Allowance and Marital Status Salary Department Employee Before This Payroll $1,600 Customer Service Bristow, Helen $ 42,000 S-0 1,250 Office S-1 33,000 Fein, Kristen S-1 Kent, Hailey 56,500 1,050 Office Barr, Brent S-3 115,420 2,080 Customer Service Alden, Liam S-3 28,000 810 Customer Service Assume the following: 1. FICA OASDI is 6.2% on $117,000; FICA Medicare is 1.45% on all earnings. 2. Each employee contributes $25 biweekly for medical insurance. 3. State income tax is 3% of gross pay. 4. FIT is calculated from Figure 7.2. 1 PROBLEM P7A-2 Employee Name 12 Bristow, Helen 13 Fein, Kristen 14 Kent, Hailey Barr, Brent 15 16 Alden, Liam 17 19 TOTALS 20 21 Employee 22 23 Bristow, Helen 24 Fein, Kristen 25 Kent, Hailey 26 Barr, Brent 27 Alden, Liam 28 29 30 31 32 TOTALS 33 7 123456NO SPINS122 8 10 11 18 35 36 Ready Allowances & Marital Status S 0 S 1 S 1 S 13 S 13 TAXABLE EARNINGS Payroll Previous Earnings (YTD) 42 000 00 33 000 00 56 500 00 115 4 2 000 28 0 0 000 FUTA/SUTA OASDI Regular FIT Current Earnings Overtime SIT PAYROLL REGISTER Gross Deductions OASDI Current Earnings (YTD) Medicare FICA AFTALAJ AN Medical Insurance. AL AMANAU AP Net Pay AU AR AS ATAU AV AW AXAYA Distribution of Expense Accounts Office Check No 56F Mostly sunny Customer Service 11:15 AM 5/23/2022 C L01 Dmitri Wittman 7A-2. April Company has five salaried employees. Your task is to use the following information to prepare a payroll register to calculate net pay for each employee: Biweekly Cumulative Earnings Allowance and Marital Status Salary Department Employee Before This Payroll $1,600 Customer Service Bristow, Helen $ 42,000 S-0 1,250 Office S-1 33,000 Fein, Kristen S-1 Kent, Hailey 56,500 1,050 Office Barr, Brent S-3 115,420 2,080 Customer Service Alden, Liam S-3 28,000 810 Customer Service Assume the following: 1. FICA OASDI is 6.2% on $117,000; FICA Medicare is 1.45% on all earnings. 2. Each employee contributes $25 biweekly for medical insurance. 3. State income tax is 3% of gross pay. 4. FIT is calculated from Figure 7.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts