Question: 7d 7. Interest Rate Risk. Consider two bonds, a 3-year bond paying an annual coupon of 4% and a 10 -year bond also with an

7d

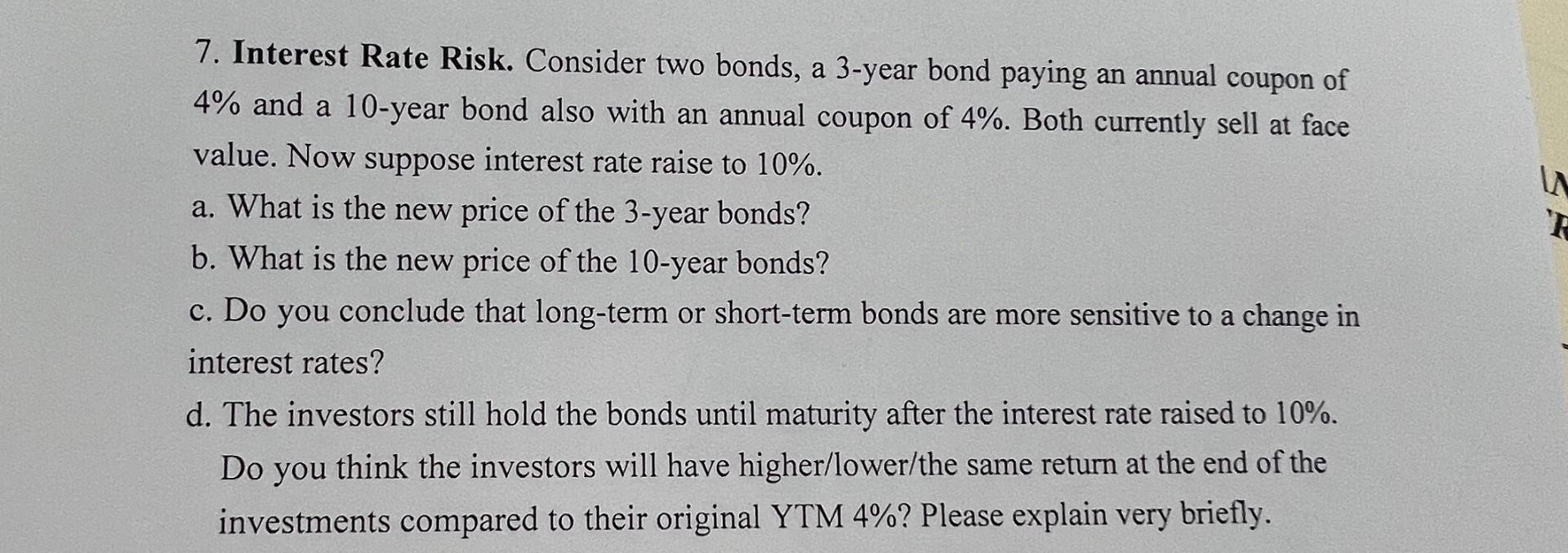

7. Interest Rate Risk. Consider two bonds, a 3-year bond paying an annual coupon of 4% and a 10 -year bond also with an annual coupon of 4%. Both currently sell at face value. Now suppose interest rate raise to 10%. a. What is the new price of the 3 -year bonds? b. What is the new price of the 10 -year bonds? c. Do you conclude that long-term or short-term bonds are more sensitive to a change in interest rates? d. The investors still hold the bonds until maturity after the interest rate raised to 10%. Do you think the investors will have higher/lower/the same return at the end of the investments compared to their original YTM 4% ? Please explain very briefly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts