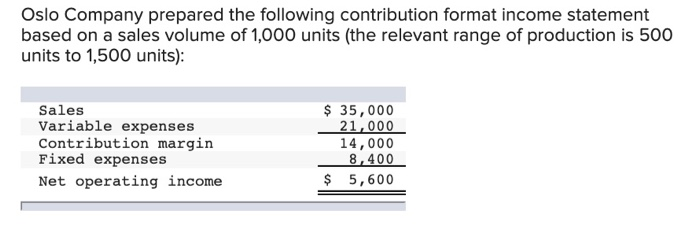

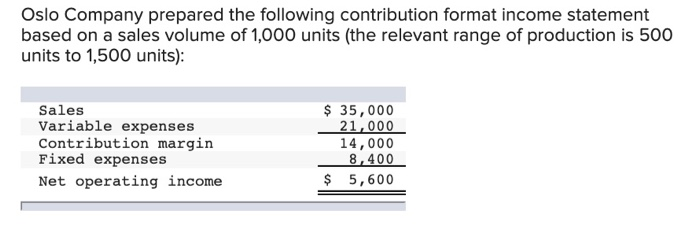

7.If the variable cost per unit increases by $1, spending on advertising increases by $1,250, and unit sales increase by 150 units, what would be the net operating income?

8.What is the break-even point in unit sales?

9.What is the break-even point in dollar sales?

10.How many units must be sold to achieve a target profit of $8,400?

11.What is the margin of safety in dollars?

12.What is the margin of safety percentage?

13.What is the degree of operating leverage?

14.Using the degree of operating leverage, what is the estimated percent increase in net operating income of a 5% increase in sales?

15.Assume that the amounts of the companys total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $8,400 and the total fixed expenses are $21,000. Under this scenario and assuming that total sales remain the same, what is the degree of operating leverage?

16. Assume that the amounts of the company's total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $8,400 and the total fixed expenses are $21,000. Given this scenario, and assuming that total sales remain the same, calculate the degree of operating leverage. Using the calculated degree of operating leverage, what is the estimated percent increase in net operating income of 5% increase in sales?