Question: 7-The default risk premium at a certain point in time may be expressed by a. a Treasury bill and a Treasury bond b. a Treasury

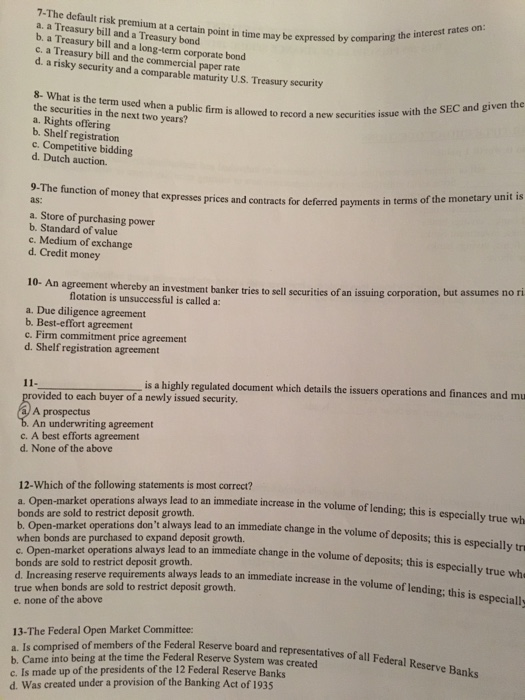

7-The default risk premium at a certain point in time may be expressed by a. a Treasury bill and a Treasury bond b. a Treasury bill and a long-term corporate bond c. a Treasury bill and the commercial paper rate d. a risky security and a comparable maturity U.S. Treasury security comparing the interest rates on 8- What is the term used when a public firm is allowed to record a new secur the securities in the next two years? a. Rights offering b. Shelf registration c. Competitive bidding d. Dutch auction. issue with the SEC and given the 9-The function of money that as: expresses prices and contracts for deferred payments in terms of the monetary unit is a. Store of purchasing power b. Standard of value c. Medium of exchange d. Credit money 10- An agreement whereby an investment banker tries to sell securities of an issuing corporation flotation is unsuccessful is called a: a. Due diligence agreement b. Best-effort agreement c. Firm commitment price agreement d. Shelf registration agreement is a highly regulated document which details the issuers operations and finances and mu vided to each buyer of a newly issued security A prospectus An underwriting agreement c. A best efforts agreement d. None of the above 12-Which of the following statements is most correct? ons always lead to an immediate increase in the volume of lending; this is especially true wh bonds are sold to restrict deposit growth. b. Open-market operations don't always lead to an immediate change in the volume of deposits; this is especially tr when bonds are purchiseod to ways lead to an immediate change in the volume of deposits; this is especially true whe c. Open-market operations always lead to an immediate change in the volu bonds are sold to restrict deposit growth. d. Increasing reserve requirements always leads to an immediate increas true when bonds are sold to restrict deposit growth. e. none of the above e in the volume of lending; this is especially 13-The Federal Open Market Committee a. Is comprised of members of the Federal Reserve board and b. Came into being at the time the Federal Reserve c. Is made up of the presidents of the 12 Federal Reserve Banks d. Was created under a provision of the Banking Act of 1935 tatives of all Federal Reserve Banks represen System was created

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts