Question: 8) 10) River Rocks (whose WACC is 11.6%) is considering an acquisition of Raft Adventures (whose WACC is 15.3%). The purchase will cost $102.2 million

8)

10)

10)

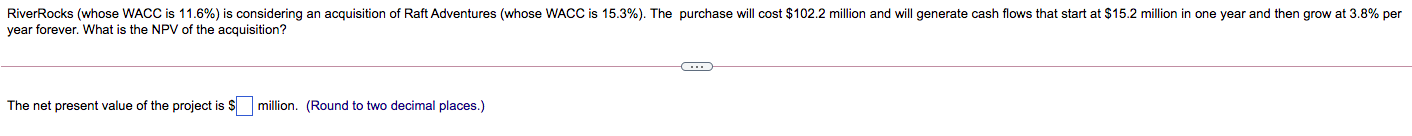

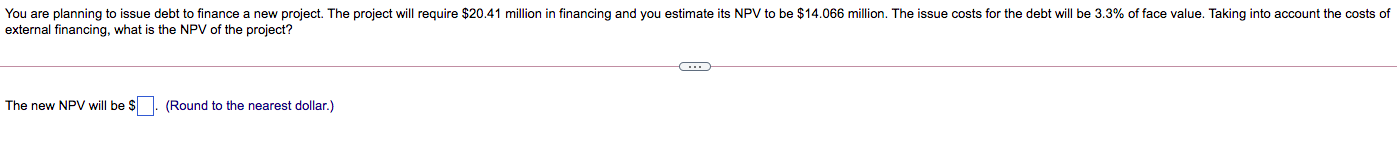

River Rocks (whose WACC is 11.6%) is considering an acquisition of Raft Adventures (whose WACC is 15.3%). The purchase will cost $102.2 million and will generate cash flows that start at $15.2 million in one year and then grow at 3.8% per year forever. What is the NPV of the acquisition? . The net present value of the project is s million. (Round to two decimal places.) You are planning to issue debt to finance a new project. The project will require $20.41 million in financing and you estimate its NPV to be $14.066 million. The issue costs for the debt will be 3.3% of face value. Taking into account the costs of external financing, what is the NPV of the project? . The new NPV will be $ . (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts