Question: Please answer all three questions for a thumbs up High Growth Company has a stock price of $23. The firm will pay a dividend next

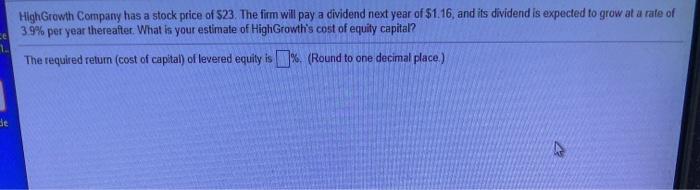

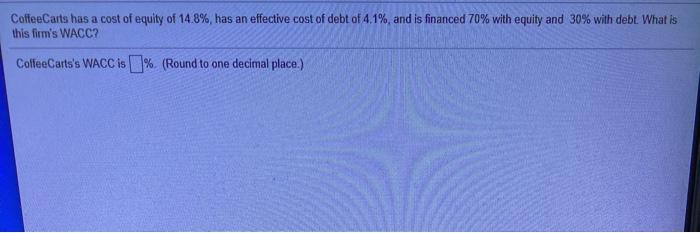

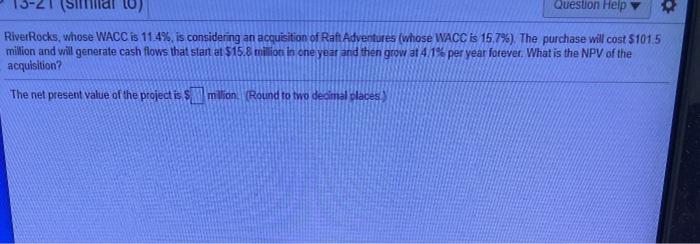

High Growth Company has a stock price of $23. The firm will pay a dividend next year of $1.16, and its dividend is expected to grow at a rate of 39% per year thereafter. What is your estimate of High Growth's cost of equity capital? The required return (cost of capital) of levered equity is %. (Round to one decimal place) de CoffeeCarts has a cost of equity of 14.8%, has an effective cost of debt of 4.1%, and is financed 70% with equity and 30% with debt. What is this firm's WACC? CoffeeCats's WACC is % (Round to one decimal place.) Simal lo) Question Help River Rocks, whose WACC is 11.4% is considering an acquisition of Raft Adventures (whose WACC is 15.7%) The purchase will cost $1015 million and will generate cash flows that start at $15.8 million in one year and then grow at 41% per year forever. What is the NPV of the acquisition? The net present value of the project is million Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts