Question: 8 / 2 6 / 2 5 , 1 : 0 3 PM Training detail: Curriculum Which of the following best describes a situation in

: PM

Training detail: Curriculum

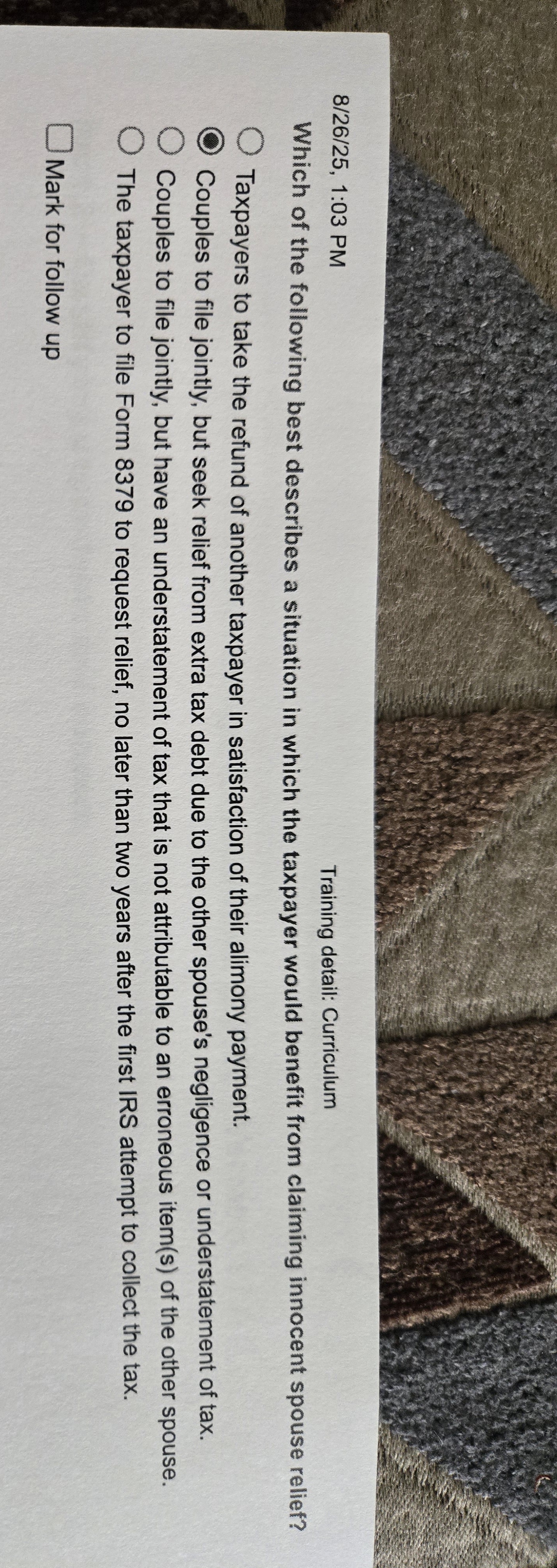

Which of the following best describes a situation in which the taxpayer would benefit from claiming innocent spouse relief?Taxpayers to take the refund of another taxpayer in satisfaction of their alimony payment.Couples to file jointly, but seek relief from extra tax debt due to the other spouse's negligence or understatement of tax.Couples to file jointly, but have an understatement of tax that is not attributable to an erroneous items of the other spouse.The taxpayer to file Form to request relief, no later than two years after the first IRS attempt to collect the tax.Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock