Question: 8 5 ? 2 5 , 2 NB PM 8 1 5 2 5 , 1 1 2 3 P M aing detail: Curriculum Lopez

NB PM

aing detail: Curriculum

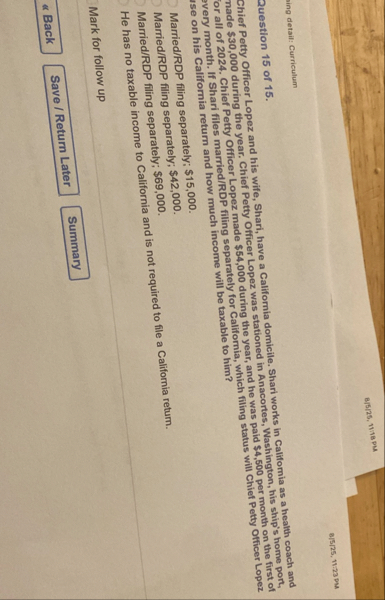

Lopez and his wife, Shari, have a California domicile. Shari works in Califomia as a health coach and ing the year. Chief Petty Officer Lopez was stationed in Anacortes. Was as a or all of Chief Petty Officer Lopez made $ during the year, and he was status will Chiet Petty Officer Lopez every month. If Sharl files marriedRDP filing sepa will be taxable to him?

Ise on

MarriedRDP filing separately; $

MarriedRDP filing separately; $ and is not required to file a California return.

He has no taxable income to California

Mark for follow up

Save Return Later

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock