Question: 8. 500 points Problem 2-40 (LO 2-6) Determine the amount of tax liability in each of the following instances. (Use the Tax Tables for taxpayers

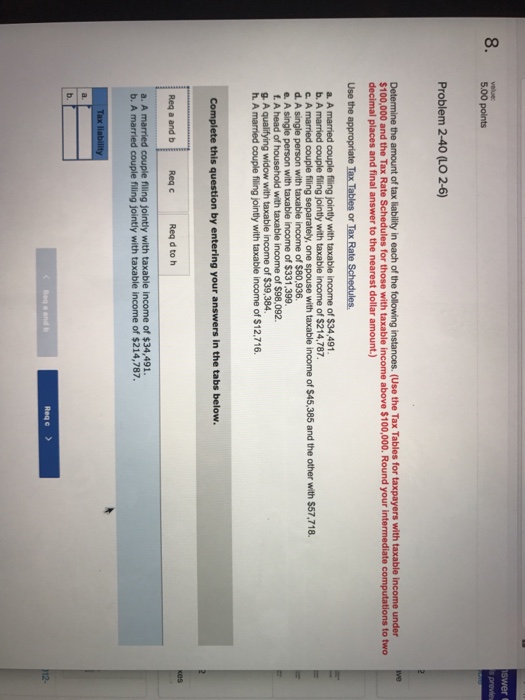

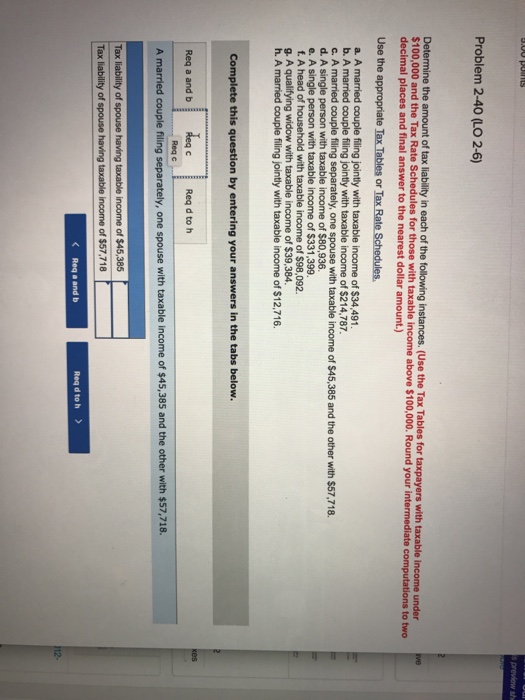

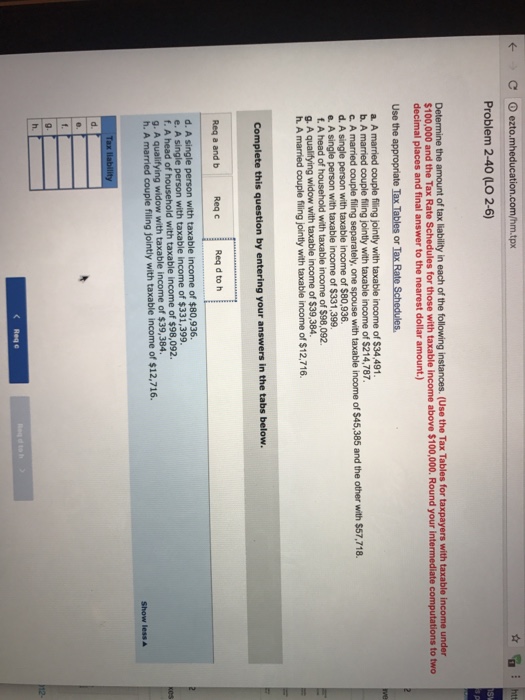

8. 500 points Problem 2-40 (LO 2-6) Determine the amount of tax liability in each of the following instances. (Use the Tax Tables for taxpayers with taxable income under $100,000 and the Tax Rate Schedules for those with taxable income above $100,000. Round your intermediate computations to two decimal places and final answer to the nearest dollar amount.) Use the appropriate Tax Tables or Tax Rate Schedules. a. A married couple filing jointly with taxable income of $34,491 b. A married couple filing jointly with taxable income of $214,787 c. A married couple filing separately, one spouse with taxable income of $45,385 and the other with $57,718 d. A single person with e. A single person with taxable income of $331,399. taxable income of $80,936. with taxable income of $98.092. h. A married couple filing jointly with taxable income of $12,716 Complete this question by entering your answers in the tabs below. Req a and b Req cReq d to h a. A married couple filing jointly with taxable income of $34,491. b. A married couple filing jointly with taxable income of $214,787. Req e >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts