Question: 8 7 points 02:24:41 The Saunders Investment Bank has the following financing outstanding. Debt: 140,000 bonds with a coupon rate of 10 percent and

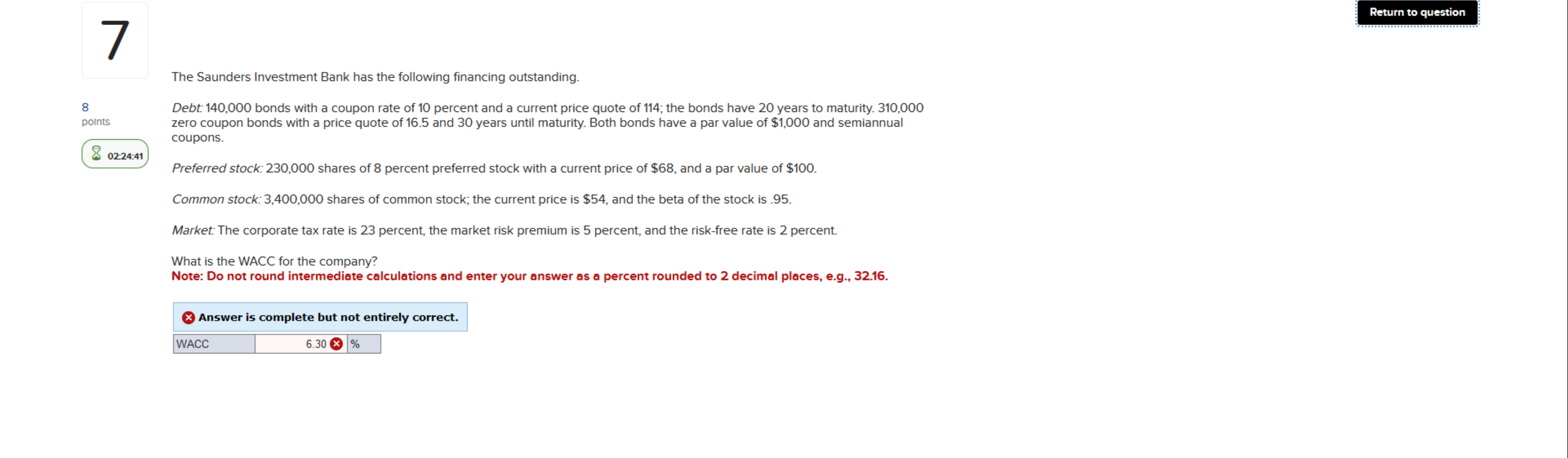

8 7 points 02:24:41 The Saunders Investment Bank has the following financing outstanding. Debt: 140,000 bonds with a coupon rate of 10 percent and a current price quote of 114; the bonds have 20 years to maturity. 310,000 zero coupon bonds with a price quote of 16.5 and 30 years until maturity. Both bonds have a par value of $1,000 and semiannual coupons. Preferred stock: 230,000 shares of 8 percent preferred stock with a current price of $68, and a par value of $100. Common stock: 3,400,000 shares of common stock; the current price is $54, and the beta of the stock is .95. Market: The corporate tax rate is 23 percent, the market risk premium is 5 percent, and the risk-free rate is 2 percent. What is the WACC for the company? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Answer is complete but not entirely correct. WACC 6.30 % Return to question

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts