Question: 8. A technical analyst is most likely to be affiliated with which investment philosophy? A. Active management B. Buy and hold C. Passive investment D.

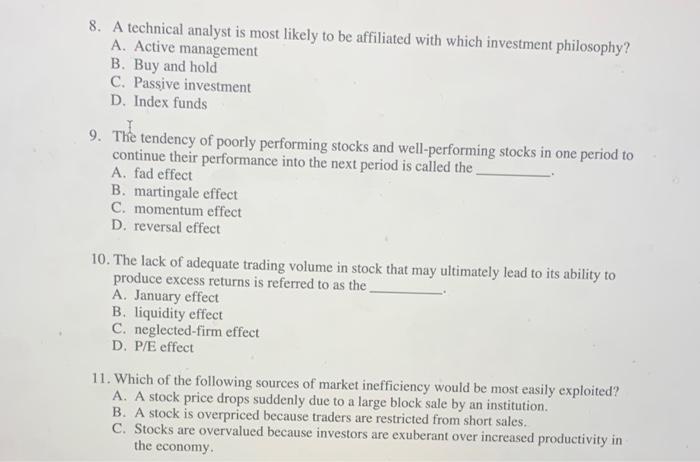

8. A technical analyst is most likely to be affiliated with which investment philosophy? A. Active management B. Buy and hold C. Passive investment D. Index funds 9. The tendency of poorly performing stocks and well-performing stocks in one period to continue their performance into the next period is called the A. fad effect B. martingale effect C. momentum effect D. reversal effect 10. The lack of adequate trading volume in stock that may ultimately lead to its ability to produce excess returns is referred to as the A. January effect B. liquidity effect C. neglected-firm effect D. P/E effect 11. Which of the following sources of market inefficiency would be most easily exploited? A. A stock price drops suddenly due to a large block sale by an institution. B. A stock is overpriced because traders are restricted from short sales. C. Stocks are overvalued because investors are exuberant over increased productivity in the economy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts