Question: 8. Assuming that the simple CAPM is valid, answer the following questions 1) Is the following scenario possible? Explain Portfolio Expected Return Standard Deviation Risk-free

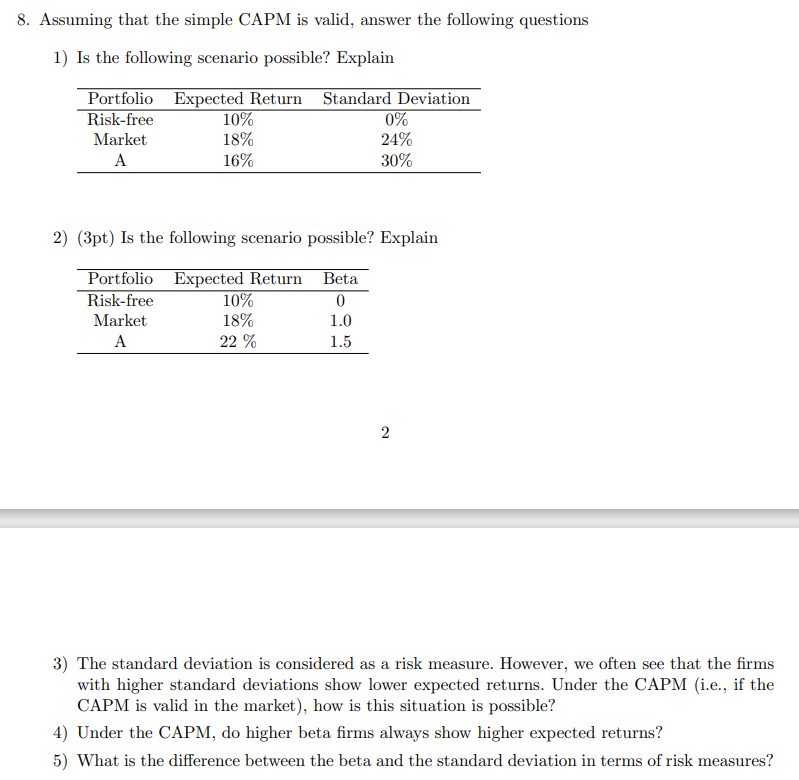

8. Assuming that the simple CAPM is valid, answer the following questions 1) Is the following scenario possible? Explain Portfolio Expected Return Standard Deviation Risk-free 10% 0% Market 18% 24% A 16% 30% 2) (3pt) Is the following scenario possible? Explain Portfolio Expected Return Beta Risk-free 10% 0 Market 18% 1.0 A 22 % 1.5 2 3) The standard deviation is considered as a risk measure. However, we often see that the firms with higher standard deviations show lower expected returns. Under the CAPM (i.e., if the CAPM is valid in the market), how is this situation is possible? 4) Under the CAPM, do higher beta firms always show higher expected returns? 5) What is the difference between the beta and the standard deviation in terms of risk measures

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts