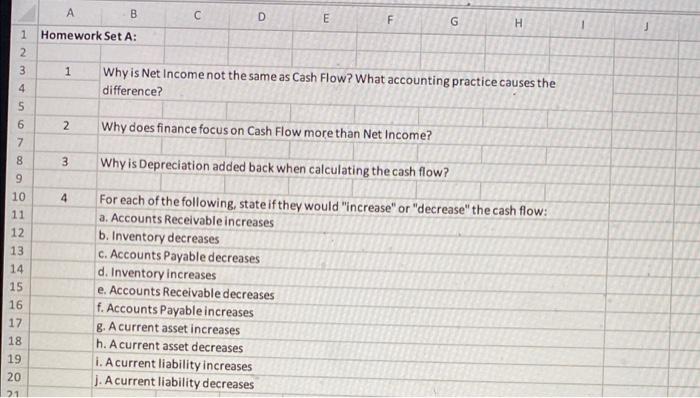

Question: 8 B D E F G H Homework Set A: 1 2 1 Why is Net Income not the same as Cash Flow? What accounting

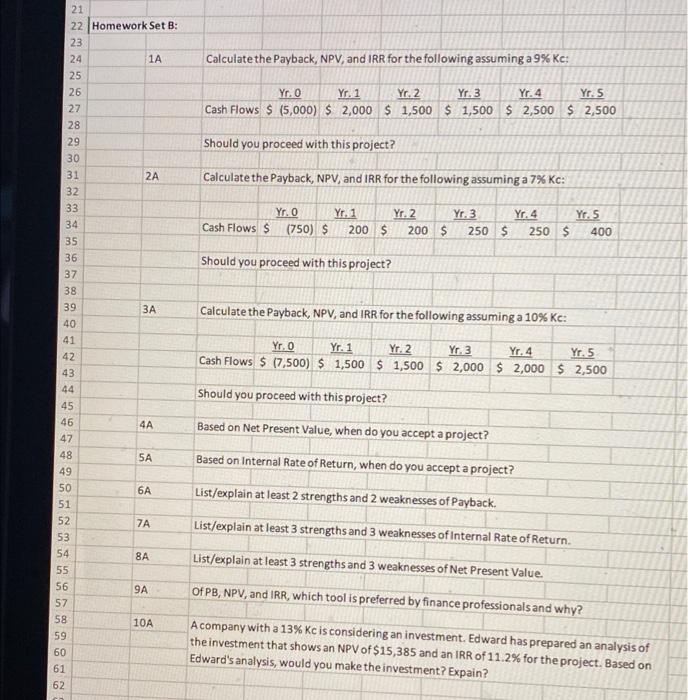

8 B D E F G H Homework Set A: 1 2 1 Why is Net Income not the same as Cash Flow? What accounting practice causes the difference? 2 Why does finance focus on Cash Flow more than Net Income? 3 000 Why is Depreciation added back when calculating the cash flow? 4 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 For each of the following, state if they would "increase" or "decrease" the cash flow: a. Accounts Receivable increases b. Inventory decreases c. Accounts Payable decreases d. Inventory increases e. Accounts Receivable decreases f. Accounts Payable increases g. A current asset increases h. A current asset decreases 1. A current liability increases J. A current liability decreases DN 00 19 20 2.1 21 22 Homework Set B: 23 24 1A 25 26 Calculate the Payback, NPV, and IRR for the following assuming a 9% Kc: Yo Yr. 1 Yr.2 Yr. 3 Yr4 Yr 5 Cash Flows $ (5,000) $2,000 $1,500 $ 1,500 $ 2,500 $ 2,500 27 Should you proceed with this project? 2A Calculate the Payback, NPV, and IRR for the following assuming a 7% Kc: 28 29 30 31 32 33 34 35 36 Yr. O YA 1 Cash Flows $(750) $ 200 $ Yr. 2 200 $ Yr.3 250 $ Yr.4 250 $ Yr. 5 400 Should you proceed with this project? 37 Calculate the Payback, NPV, and IRR for the following assuming a 10% ke: Yr. O Yr. 1 Yr.2 Yr. 3 Yr.4 Yr. 5 Cash Flows $ 17,500) $ 1,500 $1,500 $ 2,000 $2,000 $ 2,500 Should you proceed with this project? 4A Based on Net Present Value, when do you accept a project? SA Based on internal Rate of Return, when do you accept a project? 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 6A List/explain at least 2 strengths and 2 weaknesses of Payback. 7A List/explain at least 3 strengths and 3 weaknesses of internal Rate of Return List/explain at least 3 strengths and 3 weaknesses of Net Present Value. 9A Of PB, NPV, and IRR, which tool is preferred by finance professionals and why? 10A A company with a 13% Kc is considering an investment. Edward has prepared an analysis of the investment that shows an NPV of $15,385 and an IRR of 11.2% for the project. Based on Edward's analysis, would you make the investment? Expain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts