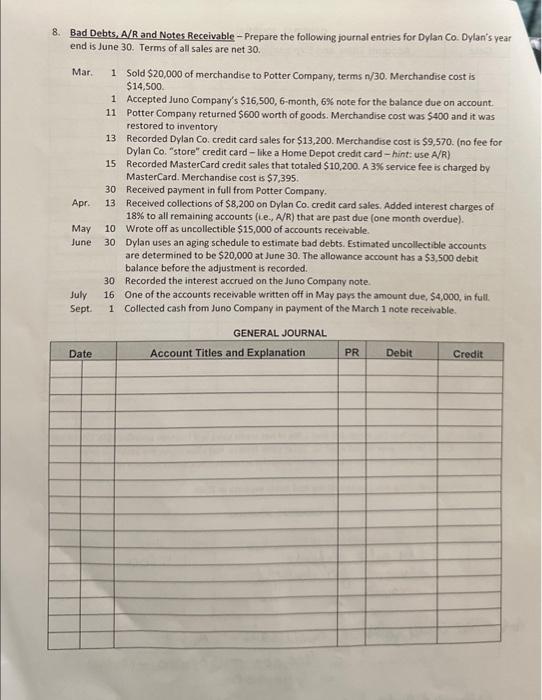

Question: 8. Bad Debts, A/R and Notes Receivable - Prepare the following journal entries for Dylan Co. Dylan's year end is June 30. Terms of all

8. Bad Debts, A/R and Notes Receivable - Prepare the following journal entries for Dylan Co. Dylan's year end is June 30. Terms of all sales are net 30. Mar. 1 Sold \\( \\$ 20,000 \\) of merchandise to Potter Company, terms \\( n / 30 \\). Merchandise cost is \\( \\$ 14,500 \\). 1 Accepted Juno Company's \\( \\$ 16,500,6 \\)-month, \6 note for the balance due on account. 11 Potter Company returned \\( \\$ 600 \\) worth of goods. Merchandise cost was \\( \\$ 400 \\) and it was restored to inventory 13 Recorded Dylan Co. credit card sales for \\( \\$ 13,200 \\). Merchandise cost is \\( \\$ 9,570 \\). (no fee for Dylan Co. \"store\" credit card - like a Home Depot credit card - hint: use A/R) 15 Recorded MasterCard credit sales that totaled \\( \\$ 10,200 \\). A \3 service fee is charged by MasterCard. Merchandise cost is \\( \\$ 7,395 \\). 30 Received payment in full from Potter Company. Apr. 13 Received collections of \\( \\$ 8,200 \\) on Dylan Co. credit card sales. Added interest charges of \18 to all remaining accounts (i.e, \\( A / R \\) ) that are past due (one month overdue). May 10 Wrote off as uncollectible \\( \\$ 15,000 \\) of accounts receivable. June 30 Dylan uses an aging schedule to estimate bad debts. Estimated uncollectible accounts are determined to be \\( \\$ 20,000 \\) at June 30 . The allowance account has a \\( \\$ 3,500 \\) debit. balance before the adjustment is recorded. 30 Recorded the interest accrued on the Juno Company note July 16 One of the accounts receivable written off in May pays the amount due, \\( \\$ 4,000 \\), in full. Sept. 1 Collected cash from Juno Company in payment of the March 1 note receivable. RENEDAI IRIDDMAI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts