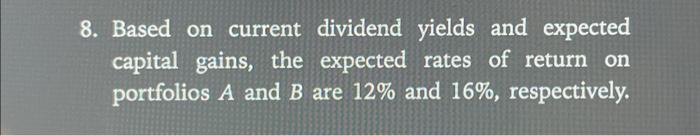

Question: 8. Based on current dividend yields and expected capital gains, the expected rates of return on portfolios A and B are 12 and 16, respectively.

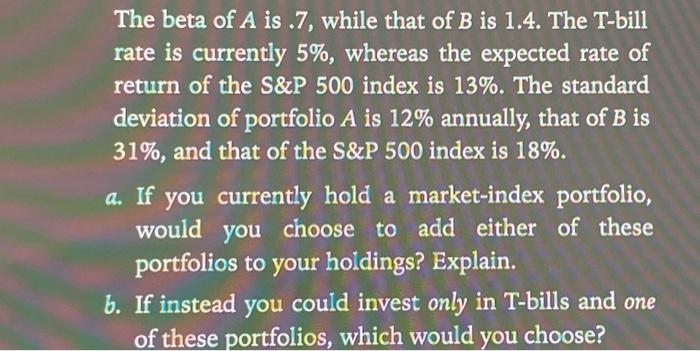

8. Based on current dividend yields and expected capital gains, the expected rates of return on portfolios A and B are \12 and \16, respectively. The beta of \\( A \\) is .7 , while that of \\( B \\) is 1.4 . The T-bill rate is currently \5, whereas the expected rate of return of the S\\&P 500 index is \13. The standard deviation of portfolio \\( A \\) is \12 annually, that of \\( B \\) is \31, and that of the S\\&P 500 index is \18. a. If you currently hold a market-index portfolio, would you choose to add either of these portfolios to your holdings? Explain. b. If instead you could invest only in T-bills and one of these portfolios, which would you choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts