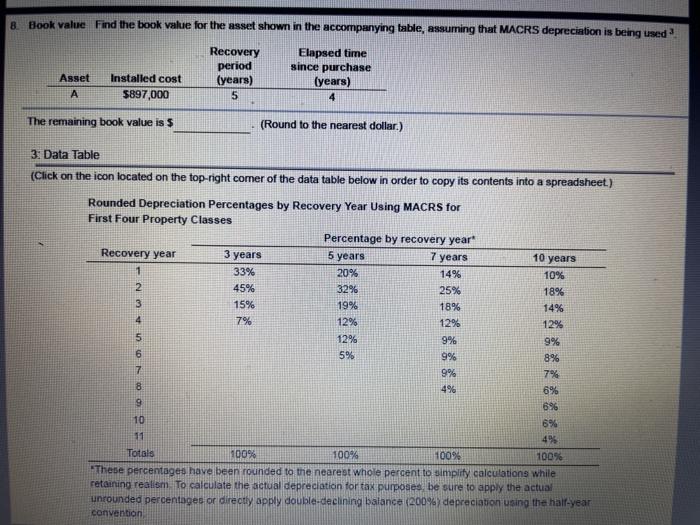

Question: 8. Book value. Find the book value for the asset shown in the accompanying table, assuming that MACRS depreciation is being used Recovery Elapsed time

8. Book value. Find the book value for the asset shown in the accompanying table, assuming that MACRS depreciation is being used Recovery Elapsed time period since purchase Asset Installed cost (years) (years) A $897,000 5 4 The remaining book value is $ (Round to the nearest dollar.) 3. Data Table (Click on the icon located on the top right comer of the data table below in order to copy its contents into a spreadsheet) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 9% 7 9% 8 4% 6% 6% 10 6% 11 4% % Totals 100% 100% 100% 100% These percentages have been rounded to the nearest whole percent to simplity calculations while retaining realism. To calculate the actual depreciation for tax purposes be sure to apply the actual unrounded percentages or directly apply double declining balance (200%) depreciation using the half-year convention 8% 7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts