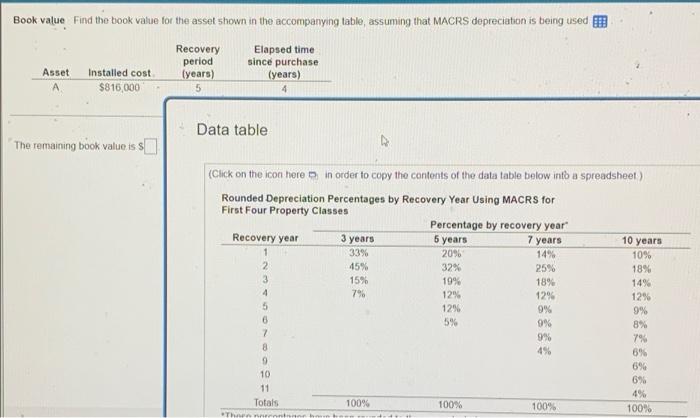

Question: Book value Find the book value for the asset shown in the accompanying table, assuming that MACRS depreciation is being used Recovery period (years) Elapsed

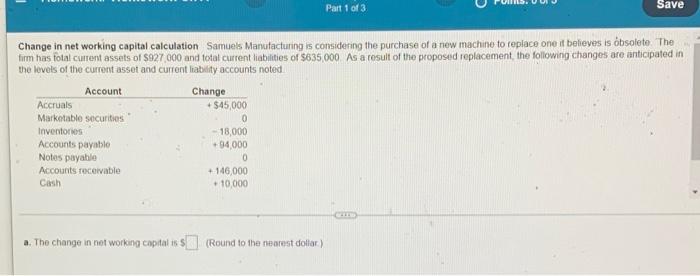

Book value Find the book value for the asset shown in the accompanying table, assuming that MACRS depreciation is being used Recovery period (years) Elapsed time since purchase (years) Asset Installed cost $816,000 Data table The remaining book value is s (Click on the icon here in order to copy the contents of the data table below into a spreadsheet Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 10 years 1 33% 2096 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 129 12% 5 1296 9% 6 5% 9% 8% 7 99% 7% 8 6% 9 694 10 6% 4% Totals 100% 100% 100% 100% 9% 11 There . Part 1 of 3 Save Change in net working capital calculation Samuels Manufacturing is considering the purchase of a new machine to replace one it believes is obsolete. The firm has fotal current assets of $927 000 and total current liabilities of $635,000 As a result of the proposed replacement the following changes are anticipated in the levels of the current asset and current liability accounts noted Account Change Accruals +$45,000 Marketable securities 0 Inventories - 18,000 Accounts payable +94,000 Notes payable 0 Accounts receivable + 146,000 Cash + 10,000 a. The change in not working capital (Round to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts