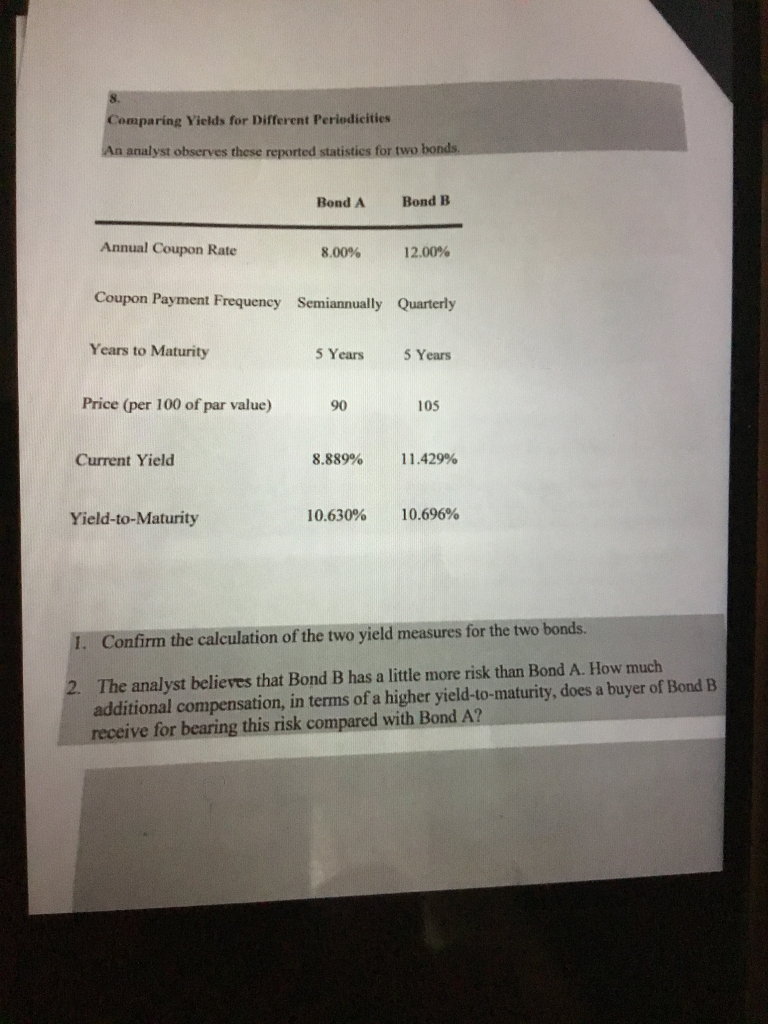

Question: 8. Comparing Yields for Different Periedicities n analyst observes these reported statistics for two bond Bond A Bond B Annual Coupon Rate 8.00% 12.00% Coupon

8. Comparing Yields for Different Periedicities n analyst observes these reported statistics for two bond Bond A Bond B Annual Coupon Rate 8.00% 12.00% Coupon Payment Frequency Semiannually Quarterly Years to Maturity 5 Years 5 Years Price (per 100 of par value) 90 105 Current Yield 8.889% 11.429% Yield-to-Maturity 10.630% 10.696% I. Confirm the calculation of the two yield measures for the two bon The analyst believes that Bond B has a little more risk than Bond A. How much additional compensation, in terms of a higher yield-to-maturity, does a buyer of Bond B receive for bearing this risk compared with Bond A? 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts