Question: 8. Consider the following three-date binomial model: - In each period the stock price either goes up by 30% or decreases by 10%. - The

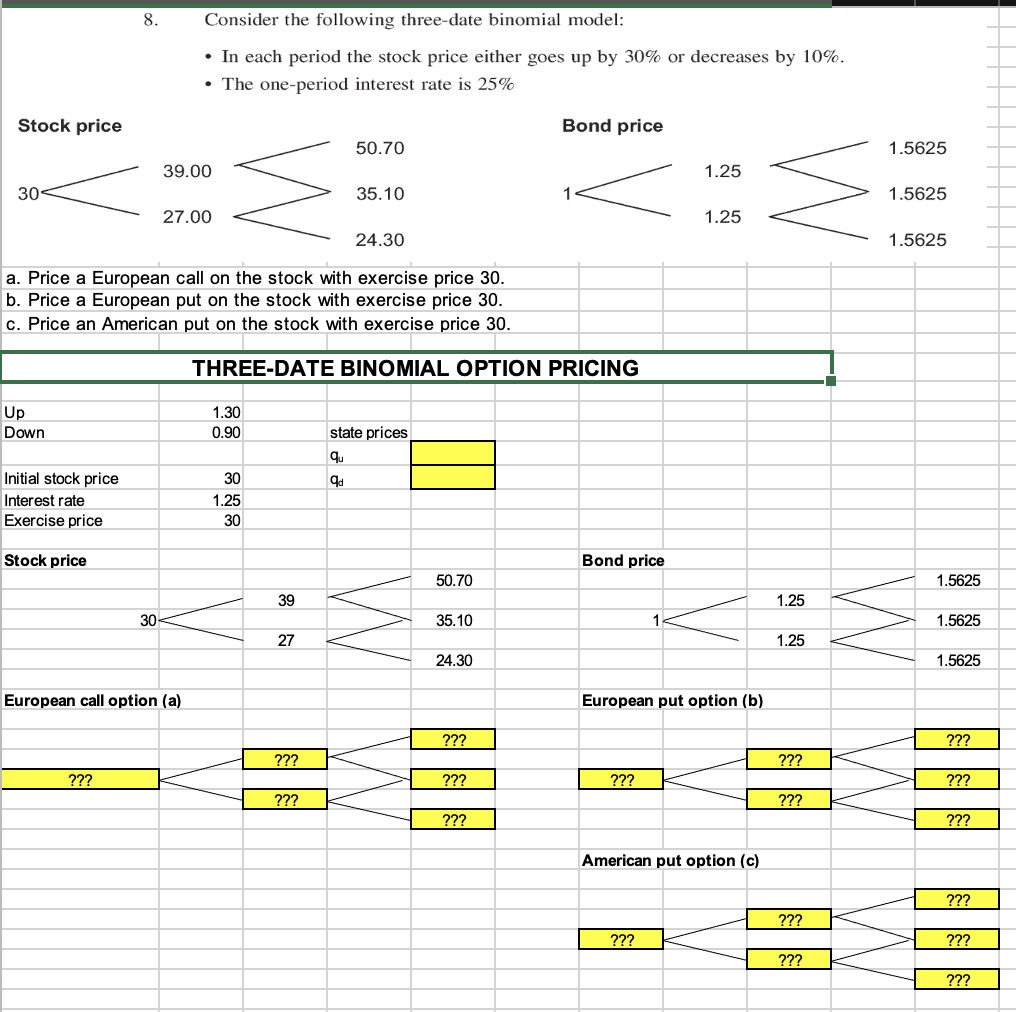

8. Consider the following three-date binomial model: - In each period the stock price either goes up by 30% or decreases by 10%. - The one-period interest rate is 25% Stock price a. Price a European call on the stock with exercise price 30 . b. Price a European put on the stock with exercise price 30 . c. Price an American put on the stock with exercise price 30. THREE-DATE BINOMIAL OPTION PRICING \begin{tabular}{|l|r|l|l|} \hline Up & 1.30 & \multicolumn{2}{|c|}{} \\ \hline Down & 0.90 & \multicolumn{1}{|c|}{ state prices } & \\ \hline & & qu & \\ \hline Initial stock price & 30 & qd & \\ \hline Interest rate & 1.25 & & \\ \hline Exercise price & 30 & & \\ \hline \end{tabular} Stock price Bond price European call option (a) European put option (b) American put option (c) 8. Consider the following three-date binomial model: - In each period the stock price either goes up by 30% or decreases by 10%. - The one-period interest rate is 25% Stock price a. Price a European call on the stock with exercise price 30 . b. Price a European put on the stock with exercise price 30 . c. Price an American put on the stock with exercise price 30. THREE-DATE BINOMIAL OPTION PRICING \begin{tabular}{|l|r|l|l|} \hline Up & 1.30 & \multicolumn{2}{|c|}{} \\ \hline Down & 0.90 & \multicolumn{1}{|c|}{ state prices } & \\ \hline & & qu & \\ \hline Initial stock price & 30 & qd & \\ \hline Interest rate & 1.25 & & \\ \hline Exercise price & 30 & & \\ \hline \end{tabular} Stock price Bond price European call option (a) European put option (b) American put option (c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts