Question: Two Step Binomial Tree Option Pricing Model. Consider the following two-period binomial model, and each period is three months. The current stock price is $50,

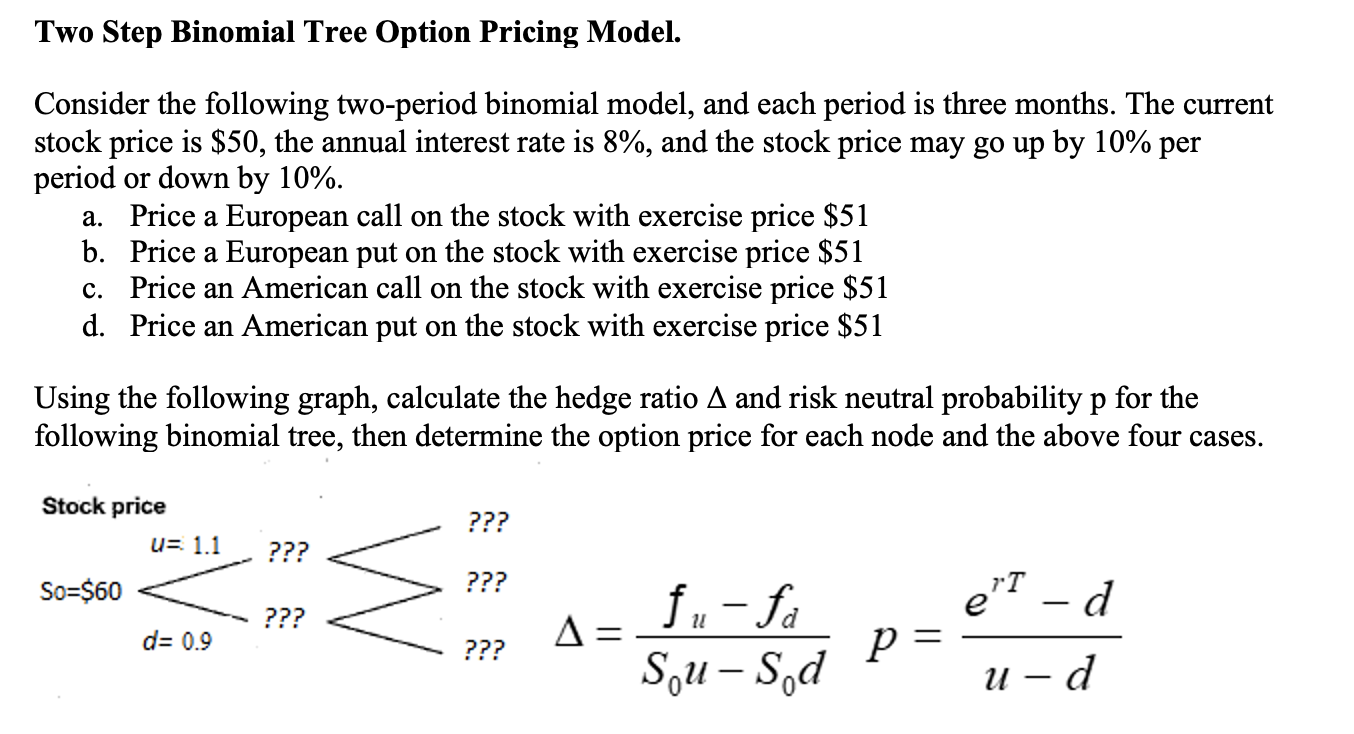

Two Step Binomial Tree Option Pricing Model. Consider the following two-period binomial model, and each period is three months. The current stock price is $50, the annual interest rate is 8%, and the stock price may go up by 10% per period or down by 10%. a. Price a European call on the stock with exercise price $51 b. Price a European put on the stock with exercise price $51 c. Price an American call on the stock with exercise price $51 d. Price an American put on the stock with exercise price $51 Using the following graph, calculate the hedge ratio A and risk neutral probability p for the following binomial tree, then determine the option price for each node and the above four cases. Stock price u= 1.1 ??? ??? So=$60 ??? e"T - d ??? d= 0.9 ??? fu-fa A= Sou Syd u d Two Step Binomial Tree Option Pricing Model. Consider the following two-period binomial model, and each period is three months. The current stock price is $50, the annual interest rate is 8%, and the stock price may go up by 10% per period or down by 10%. a. Price a European call on the stock with exercise price $51 b. Price a European put on the stock with exercise price $51 c. Price an American call on the stock with exercise price $51 d. Price an American put on the stock with exercise price $51 Using the following graph, calculate the hedge ratio A and risk neutral probability p for the following binomial tree, then determine the option price for each node and the above four cases. Stock price u= 1.1 ??? ??? So=$60 ??? e"T - d ??? d= 0.9 ??? fu-fa A= Sou Syd u d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts