Question: 8. DIVIDEND PRACTICE PROBLEMS Assume ks = 10% for problems 1 - 6. 1. Perpetuity The XYZ Corp. pays a $3 dividend every year. If

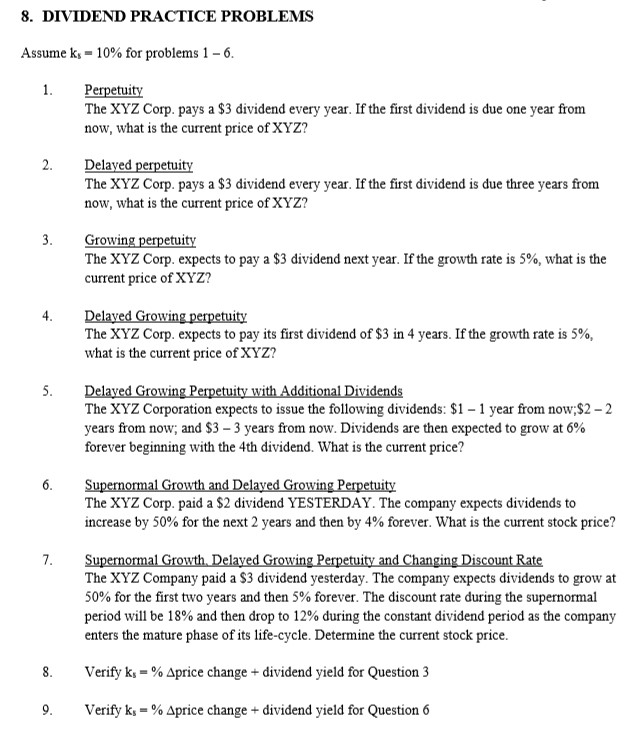

8. DIVIDEND PRACTICE PROBLEMS Assume ks = 10% for problems 1 - 6. 1. Perpetuity The XYZ Corp. pays a $3 dividend every year. If the first dividend is due one year from now, what is the current price of XYZ? Delayed perpetuity The XYZ Corp. pays a $3 dividend every year. If the first dividend is due three years from now, what is the current price of XYZ? Growing perpetuity The XYZ Corp. expects to pay a $3 dividend next year. If the growth rate is 5%, what is the current price of XYZ? 4. Delayed Growing perpetuity The XYZ Corp. expects to pay its first dividend of $3 in 4 years. If the growth rate is 5%, what is the current price of XYZ? Delaved Growing Perpetuity with Additional Dividends The XYZ Corporation expects to issue the following dividends: $1 - 1 year from now;$2 - 2 years from now; and $3 - 3 years from now. Dividends are then expected to grow at 6% forever beginning with the 4th dividend. What is the current price? Supernormal Growth and Delayed Growing Perpetuity The XYZ Corp. paid a $2 dividend YESTERDAY. The company expects dividends to increase by 50% for the next 2 years and then by 4% forever. What is the current stock price? Supernormal Growth. Delayed Growing Perpetuity and Changing Discount Rate The XYZ Company paid a $3 dividend yesterday. The company expects dividends to grow at 50% for the first two years and then 5% forever. The discount rate during the supernormal period will be 18% and then drop to 12% during the constant dividend period as the company enters the mature phase of its life-cycle. Determine the current stock price. Verify ks =% Aprice change + dividend yield for Question 3 9. Verify ks =% Aprice change + dividend yield for Question 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts