Question: 8. Hedging strategy to protect against falling prices Aa Aa Price fluctuations in commodities can have significant consequences for companies, especially if the fluctuation involves

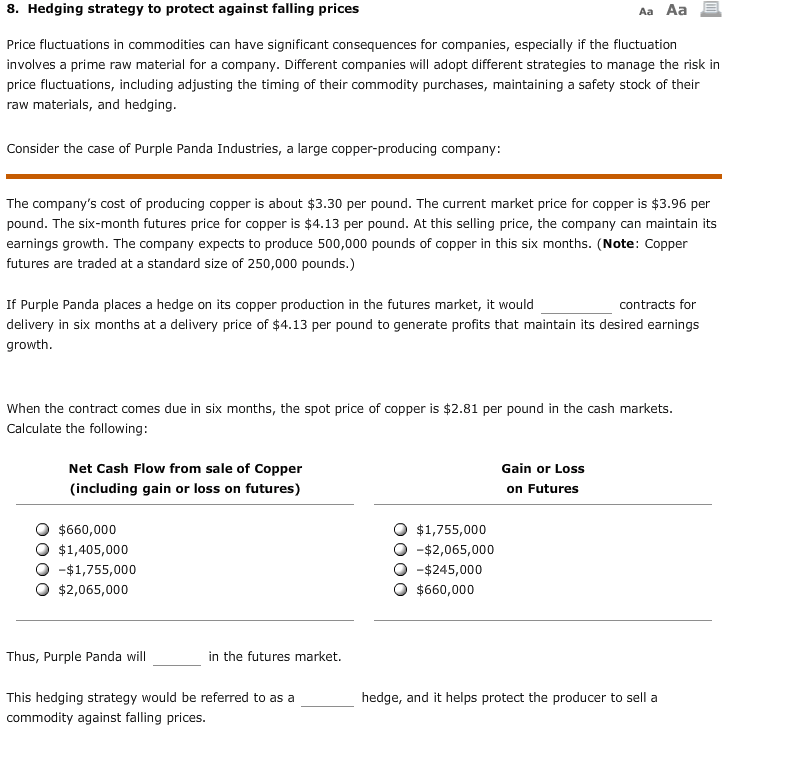

8. Hedging strategy to protect against falling prices Aa Aa Price fluctuations in commodities can have significant consequences for companies, especially if the fluctuation involves a prime raw material for a company. Different companies will adopt different strategies to manage the risk in price fluctuations, including adjusting the timing of their commodity purchases, maintaining a safety stock of their raw materials, and hedging. Consider the case of Purple Panda Industries, a large copper-producing company: The company's cost of producing copper is about $3.30 per pound. The current market price for copper is $3.96 per pound. The six-month futures price for copper is $4.13 per pound. At this selling price, the company can maintain its earnings growth. The company expects to produce 500,000 pounds of copper in this six months. (Note: Copper futures are traded at a standard size of 250,000 pounds.) If Purple Panda places a hedge on its copper production in the futures market, it would contracts for delivery in six months at a delivery price of $4.13 per pound to generate profits that maintain its desired earnings growth. When the contract comes due in six months, the spot price of copper is $2.81 per pound in the cash markets. Calculate the following: Net Cash Flow from sale of Copper Gain or Loss |(including gain or loss on futures) on Futures $660,000 $1,755,000 O $1,405,000 $1,755,000 -$2,065,000 $245,000 $2,065,000 $660,000 Thus, Purple Panda will in the futures market. This hedging strategy would be referred to as a hedge, and it helps protect the producer to sell a commodity against falling prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts