Question: 8. How large does an exit have to be to justify a $10M investment for a 28% ownership if we expect to wait 5-7 years

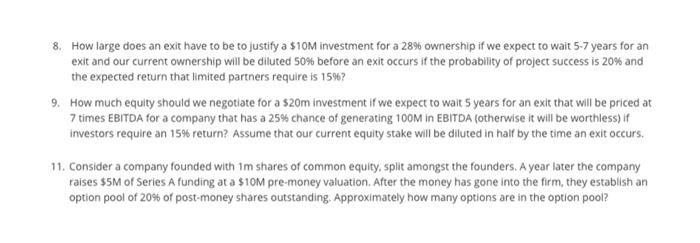

8. How large does an exit have to be to justify a $10M investment for a 28% ownership if we expect to wait 5-7 years for an exit and our current ownership will be diluted 50% before an exit occurs if the probability of project success is 20% and the expected return that limited partners require is 15%? 9. How much equity should we negotiate for a $20m Investment if we expect to wait 5 years for an exit that will be priced at 7 times EBITDA for a company that has a 25% chance of generating 100M in EBITDA (otherwise it will be worthless) if investors require an 15% return? Assume that our current equity stake will be diluted in half by the time an exit occurs. 11. Consider a company founded with Im shares of common equity, split amongst the founders. A year later the company raises $5M of Series A funding at a $10M pre-money valuation. After the money has gone into the firm, they establish an option pool of 20% of post-money shares outstanding. Approximately how many options are in the option pool

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts